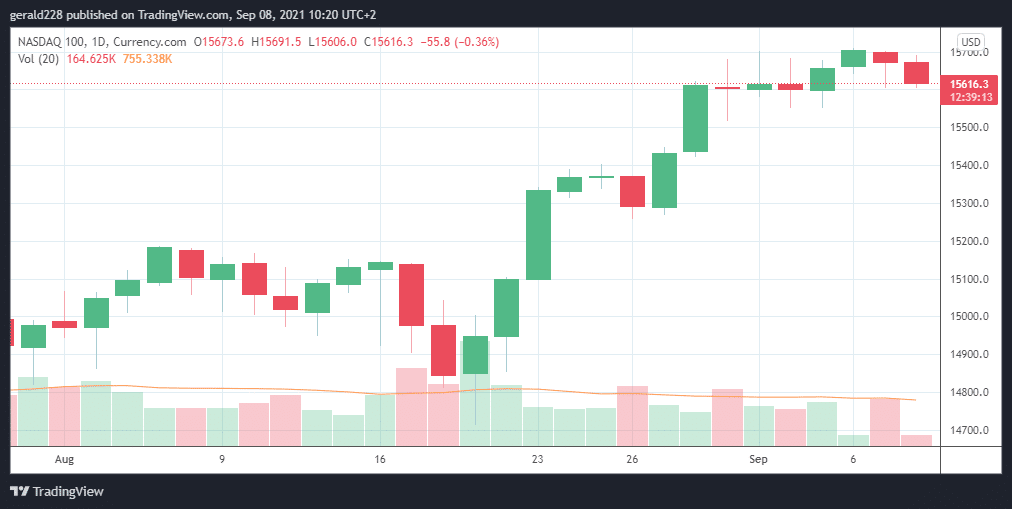

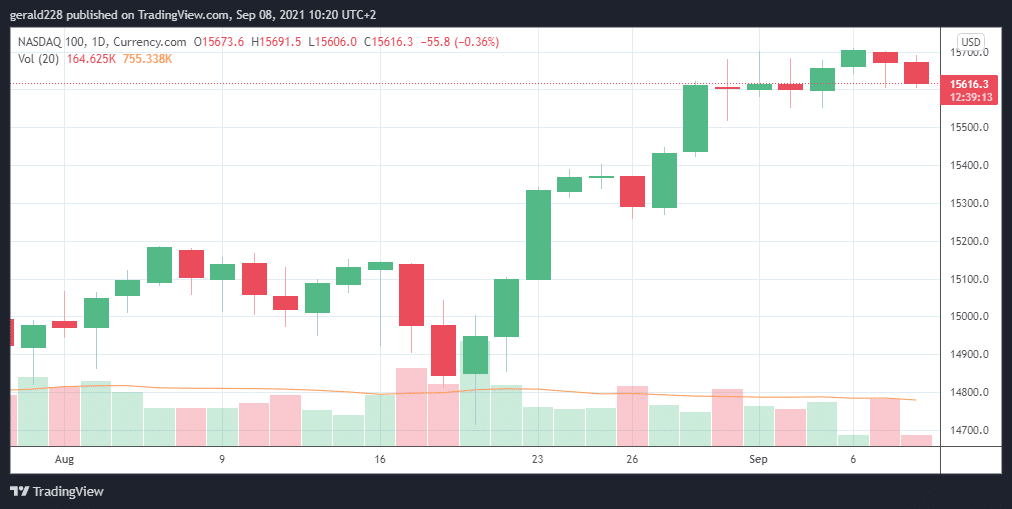

- The NASDAQ Price Has Continued increasing, Reaching New All Time Highs

- Although Inflation and Covid19 Concerns Remains, this has not seemed to affect the NDX

- Economic tapering could start sooner rather than later although the NASDAQ has also seemingly priced in such concerns.

The NASDAQ price has continued appreciating over the past days and has reached another all time high of 15698 with more bullish sentiment on the horizon. It seems that the cocktail of inflation worries, Covid19 concerns and the timing of economic tapering off have not had too much effect on the NDX.

Fed Chair Jerome Powell has still not given any indication on when the economic tapering of support is to start. The rather dismal Non-Farm Payroll Jobs Report of last Friday has not moved the market so much and after a short descent on Friday, the Nasdaq price recovered well in the past two sessions to register another all-time high.

It appears that investors in tech stocks have priced in the economic situation and the Afghanistan turmoil has also receded into the background, at least for now. Today’s session started slightly in the red although this may recover by market close.

If you want to start trading forex then have a look at this Trading Forex For Beginners Guide.

Short Term Prediction For NASDAQ Price: More Upside As Tech Stocks Remain Growing

It is worth a reminder that the NASDAQ price has now risen an astonishing 8% since its July 20 low of 14515 which is remarkable with all the economic turmoil around. It looks like the NDX is also poised for further gains as the economy continues to re-open and investors increase their risk appetite.

If the bullish thesis were to prevail, the next stop for the NASDAQ price would be the 15750 mark. Resistance at that level should be easily overcome and a further appreciation in price should continue.

If on the other hand, a bearish thesis comes into play, the NASDAQ price would probably suffer a drop close to the 15600 mark. Further price drops could occur if another large sell off occurs but that looks unlikely at this point.

If you wish to begin some forex trading then you should have a look at these Top Forex Brokers.

Long Term Prediction For NDX: More Upside But With Possible Bouts of Retracement

Although the economy in the US is still in a considerable state of uncertainty, not to mention the world’s, the NASDAQ price seems to be performing quite well. Fed Chair Powell still hasn’t indicated when economic support for Covid19 will begin tapering off although that shouldn’t be too far off with investors already seemingly pricing this in.

All in all, long term predictions for the NASDAQ price remain bullish. Tech stocks continue to outperform all others and seasoned investors will still look for safe havens in this regard.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.