- Ethereum London hard fork will go live on August 4.

- The EIP-1559 is primarily designed to bring down the currently exploitative gas fees.

- Ethereum could become more competitive with the upgrade in place ahead of ETH 2.0.

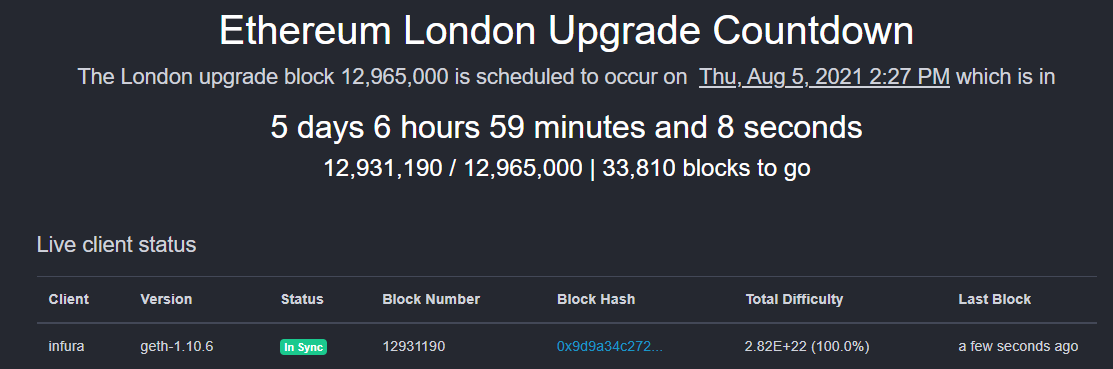

The much-awaited and publicized Ethereum London hard fork is soon approaching its debut. According to Ethernodes.org, the upgrade’s countdown is only five days away at the time of writing. This upgrade, set to revolutionize the largest smart contract platform and ecosystem globally, will launch on August 4.

Ethereum London Hard Fork Looms

Ethereum London hard fork countdown

What Is The Ethereum London Hard Fork?

The once-controversial upgrade contains five Ethereum Improvement Proposals (EIPs) introducing changes to the code that must receive a node from the stakeholder consensus. Perhaps you are privy to one of these improvements, the much-anticipated EIP-1559. However, you may not fully understand what it entails.

With that in mind, Forex Crunch will dive into the nitty and gritty of this upgrade as a whole to help you internalize what it means for Ethereum and the ecosystem. We understand that some investors are preparing short-term investment decisions based on this upgrade, hence its importance before looking for how to buy cryptocurrency.

Understanding The EIP-1559

The EIP-1559 has evoked a lot of excitement and controversy among network stakeholders. Some supported the change right from the beginning, while others have been opposed to it all along. This particular code change brings forth a couple of components. The first one introduces a base fee attached to every transaction taking place on the Ethereum blockchain.

Although this sounds rigid, it helps the user approximate the fee. The current fee system operates in some way like an auction house, meaning people tend to overpay for their transactions to be prioritized. According to Tim Beiko, a developer with the Ethereum Foundation, “think like a 20% reduction, not like a 20x reduction.”

The second component of EIP-1559 ensures that the fee is not channeled to miners, the people currently operating hardware in different locations globally to validate and process transactions. In turn, the fee is burned and sent to an inaccessible wallet. In simpler terms, the coins are removed from circulation, forming “deflationary pressure on the network,” according to Beiko, coin burns tend to squeeze supply as demand increases. This factor may bolster Ethereum price significantly upward.

What Is The EIP-3198?

The EIP-3198 is in some way an extension of the EIP-1559. It expanses the user experience explained above to smart contracts. Note that smart contracts refer to self-executing programs on the blockchain and based on pre-determined conditions.

These contracts are the powerhouse of the massive decentralized finance (Defi) sector. Their main goal or purpose is to eliminate the middlemen while putting the primary user in control. The Defi ecosystem on the Ethereum blockchain has been grappling with high gas fees, threatening its sustainability. With lower transactions fees, the sector is expected to hit significant milestones.

The EIP-3529

The EIP-3529 was authored by one of Ethereum’s co-founders, Vitalik Buterin and Martin Swende. According to Ethereum Improvement Proposals, it is designed to remove gas refunds for SELFDESTRUCT and reduce gas for SSTORE to a much lower level whereby “refunds are still substantial, but they are no longer high enough for current “exploits” of the refund mechanism to be viable.”

EIP-3529’s primary goal is to reduce network clogging, as users keep junk data on the network to clean it up when gas fees are higher to get refunds.

The EIP-3529

The EIP-3529 is not significant for itself, according to Beiko. However, it is essential for the network because it sets the framework for updates by securing some space to allow developers to create new versions of smart contracts. Look at it as a trick to introduce new functionality to the Ethereum Virtual Machine (EVM) without changing anything.

The EIP-3554

EIP-3554 is a proposal developed to delay the commonly known “difficulty bomb” to the second quarter of 2022. The bomb will make it challenging for miners to validate and process transactions through solving complex cryptographic problems. In other words, the difficulty bomb will make the Ethereum network slower. Therefore, EIP-3554 diffuses this bomb to create time for Ethereum 2.0 to fully become operational by transitioning from the Proof-of-Work (PoW) consensus to a Proof-of-Stake (PoS) protocol.

Ethereum London Hard Fork Expected Impact After Launch In August

The upgrade is a wholesome improvement to the Ethereum network, especially when it comes to gas fees reduction. However, it also sets the pace for the full implementation of Ethereum 2.0. Key industry leaders are confident that this upgrade is what Ethereum needs to remain competitive in a space where innovation is fast-changing.

Analysts with Goldman Sachs, one of the biggest investment banks globally, have in the recent past released reports on why Ethereum could surpass Bitcoin as the ultimate store of value. The analysts theorized Ether as the asset with the utmost real-use potential, considering the ballooning smart contracts development space. In their opinion, Bitcoin is indeed the flagship of the cryptocurrency industry but loses out on Ethereum’s real-world use cases.

It is essential to realize the impact of the Ethereum London hard fork is not all positive. Some gas tokens such as GST2 and CHI may become useless, perhaps obsolete. Primarily, these tokens are utilized by developers to reserve lower prices for the deployment of smart contracts. With the implementation of EIP-3529, the tokens will be “worthless,” according to Alex Kroeger.

amidst the coordination for EIP-1559, I admit we have neglected comms on EIP-3529: Reduction in refunds,

PSA: these tokens will be w/out functions in <1wk, divest accordingly

fortunately i think the majority of holders were more sophisticated market makers, users eg. @1inch https://t.co/2SGFz2llm4

— trent.eth (@trent_vanepps) July 30, 2021

Ethereum Price Set For A Pullback Ahead Of A Rally

At the time of writing, Ether is teetering slightly above $2,400. This follows a rebound from July’s primary support at $1,700. While the recovery has been consistent, its ability to continue to $3,000 is doubtful from a technical perspective.

Read our detailed guide for more crypto signals to help you make better trading decisions.

ETH/USD Four-Hour Chart Flashes Sell Signal

ETH/USD price chart by Tradingview

Traders must keep in mind forming a golden cross pattern, a highly bearish crypto signal that occurs when a short-term moving average (50-day SMA) crosses below a long-term moving average (200-day SMA). It infers the continuation or beginning of a downtrend and that Ethereum may consolidate at a lower price level in the near term.

Therefore, a correction from the current price level is highly probable, whereby Ethereum price could retest the support at $2,000 and $1,700 before resuming the uptrend. Nonetheless, with the Ethereum London hard fork approaching, the downtrend may be aborted, leading to the extension of the prevailing uptrend toward the all-time highs of $4,500.

Looking to buy or trade Ethereum now? Invest at eToro!

Capital at risk