- XAU/USD had the worst month in June 2021 since March 2013.

- Gold finds little traction amid fears of the Delta variant of COVID-19.

- Strong US Dollar is keeping a lid on gains of the precious metal.

According to analysts’ observations, the losses suffered by the yellow metal in June 2021 became the most significant in more than 8 years. Gold saw such a big monthly decline in the spring of 2013.

The most successful months for the precious metal in the first half of the year were April and May. As a result, gold ended in positive territory, thanks to which the asset managed to enter positive dynamics in the second quarter. During this period, gold jumped around 5%.

Experts remind that the pricing of precious metals is directly dependent on two factors, i.e. the exchange rate of the US currency and the yield on 10-year US bonds.

Over 6 months, the Dollar Index, which determines the Greenback ratio to a basket of currencies of six countries, increased by 2.3%. Also, the positive dynamics were demonstrated by the yield of US Treasury bonds. The indicator increased to 1.443% against 0.916%.

The strengthening of the Dollar and the increase in profitability made the precious metal less profitable for investors, which negatively affected its value.

Decline in safe haven interest

In addition, interest in safe-haven assets, which traditionally include gold, declined amid a growing appetite for more risky assets. This happened as the optimistic statistics of the Eurozone, US and China were released.

As for industrial metals, the first half of the year, on the contrary, turned out to be successful for them. Against the backdrop of the recovery in economic activity, the demand for raw materials was actively increasing. As a result, asset prices rose along with it.

Thus, the largest increase since the beginning of the year was shown by aluminum. It gained more than 27% in price. Copper (+21%) and nickel (+10%) also rose in price over 6 months.

Even though the strong Dollar held back the price of industrial metals in the second quarter of the year, assets still showed significant dynamics. For example, the price of aluminum jumped 15%, while nickel rose 13% and copper 7%.

Yesterday’s performance of XAU/USD

Gold finished the last day of June on a positive note. Yesterday the value of the asset grew by 0.5%. Thus, its final price on the Comex exchange in New York was $1,771.60.

Silver quotes also paved the way up. The July futures contract gained 1.1% to reach $ 26.15.

Today’s performance of XAU/USD

On Thursday morning, gold continues to hold the upward course taken the day before. The main catalyst for the rise of prices is the growing fear about the active spread of the new variant of the Delta coronavirus.

Some countries are seriously considering imposing new lockdowns. This could slow down the recovery in economic activity, which will have a beneficial effect on the pricing of safe-haven assets, including gold.

At the time of writing, the precious metal was trading at $ 1,777. The difference from the previous close was $5.25, or 0.3%.

Technical outlook for XAU/USD

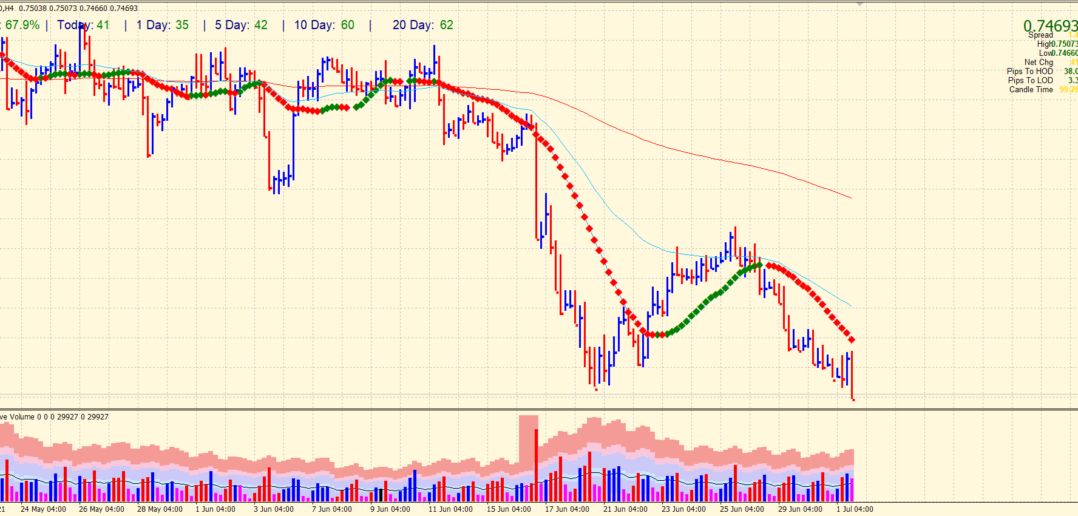

The precious metal is wobbling around 20-period SMA on the 4-hour chart. Meanwhile, an upside attempt failed as the price remained capped by the 50-SMA. However, the volume is slightly encouraging for the buyers. But there is no clear clue for bulls to overcome.

Resistance levels: 1780, 1795, 1815

Support levels: 1750, 1723, 1710

4-hour chart of XAU/USD

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.