- USD/JPY posts fresh 15-month highs amid broader Dollar strength.

- Macroeconomic indicators of Japan are positive.

- Investors are awaiting the NFP report on Friday to find further impetus in the market.

The Dollar hit a new 15-month high against the Yen. It hovered around multi-month highs against other major currencies on Thursday ahead of a key US employment report that could provide clues about when the Federal Reserve will begin to cut stimulus.

The US currency rose to 111.25 yen for the first time since March 26, 2020, after which it traded virtually unchanged from 111.09 on Wednesday.

Forex traders have seen the Dollar Index, which measures the Dollar against six peers, hold just below the 2.5-month high of 92.451 reached in the previous session, rising to 92.415 on the day.

The index posted its best month since November 2016 in June, fuelled by an unexpected tough shift by the Federal Open Market Committee (FOMC) in the middle of last month, when officials announced two interest rate hikes by the end of 2023.

Macroeconomic statistics from Japan are providing moderate support to the Japanese currency. Thus, the volume of industrial production in the country in May increased by 22% y / y after increasing by 15.8% y / y in April. Analysts had expected the rate to accelerate by only 20%. But monthly, production volumes dropped sharply by 5.9% m / m after rising by 2.9% m / m. Real dynamics also turned out to be worse than forecasted at the level of –2.4% m / m.

NFP expectations: 700k jobs growth expected

Traders are awaiting Friday’s US non-farm payrolls report to confirm the forecast. Economists polled by Reuters expect 700,000 jobs to grow last month from 559,000 in May and an unemployment rate of 5.7% versus 5.8% in the previous month.

The US Dollar extended its gains on Wednesday after data showed that the number of US private-sector jobs increased by 692,000 in June, beating expectations.

Bidders are in no hurry to open new positions, preferring to wait for the final US report on the labor market for June. Analysts are counting on the resumption of growth in new jobs after a slowdown to 278k in April.

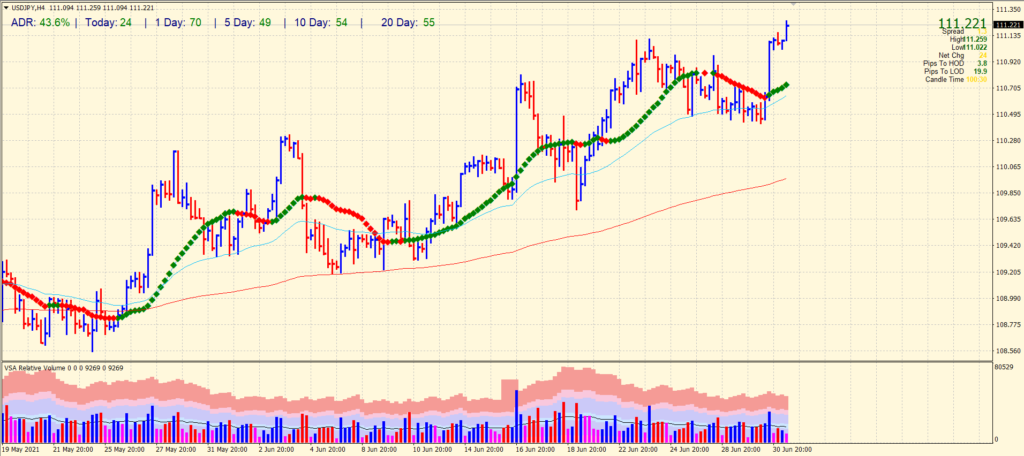

USDJPY Technical outlook

The USDJPY pair looks positive, cracking above the interim resistance of 111.10. The volume is signalling bullish action, and the price lies well above the 20, 50 and 200 SMAs on the 4-hour chart. However, the recent bullish bar lacks momentum to keep up the gains.

Resistance levels: 110.81, 111.00, 111.34, 111.70.

Support levels: 110.42, 110.18, 109.83, 109.29.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.