EUR/NZD is trading in the red at 1.6975 on the H4 chart but it could still resume its growth. The pair has moved sideways lately and is currently trying to escape from this range. An upside breakout, a new higher high could signal a strong growth ahead.

The New Zealand Dollar is into a corrective phase versus USD, GBP and JPY, and not only versus the Euro. The New Zealand GDP could bring heightened price action on EUR/NZD trades tomorrow. The Gross Domestic Product is expected to increase by 0.5% in the first quarter versus a 1.0% drop in the previous reporting period.

The eurozone will publish the Final CPI and Final Core CPI tomorrow. EUR/USD needs a bullish spark to be able to resume its growth as the pair is located at resistance right now.

Market participants could interpret soft inflation numbers as indicative of an economy that is not roaring back as fast as would be liked.

On the other hand, if inflation jumps in an unexpected way then it could lead to an opposing reaction, given the skittishness of the markets as they attempt to get a handle on inflation expectations.

Central bankers contend that any spike in inflation would be purely temporary and therefore would not require any tightening in terms of either tapering asset purchases or raising interest rates.

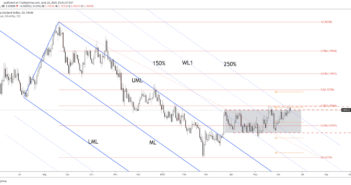

EUR/NZD: technical analysis

EUR/NZD is pressuring the 250% Fibonacci line, the R1 (1.7021), and the 38.2% retracement level. Also, the 1.6989 – 1.7036 represents a strong resistance area. The pair is at resistance, so only a valid breakout could suggest a border growth in the upcoming period.

Staying below these resistance levels could signal a potential decline. Technically, it looks strongly bullish, it has managed to stay higher despite several false breakouts above 1.6989 static resistance.

Jumping and stabilizing above these obstacles, making a new higher high, to close above 1.7058 yesterday’s high, validates an upside journey towards 50% (1.7272) and up to 61.8% (1.7497) levels.

Get Free Forex Signals – 82% Win Rate!

3 Free Forex Signals Every Week – Full Technical Analysis