- EUR/USD has dropped below 1.1990 after US Treasury Secretary Yellen talked about rate hikes.

- Two critical US data points are set to rock the currency pair.

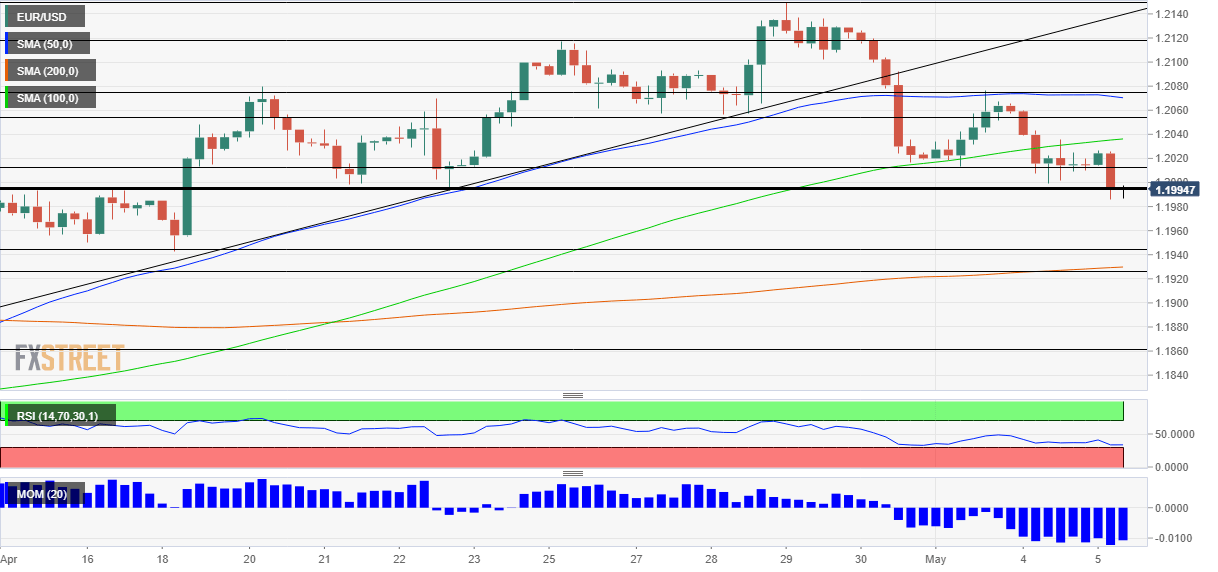

- Wednesday’s four-hour chart is pointing to further falls.

“It may be that interest rates will have to rise somewhat” – Treasury Secretary Janet Yellen’s hike talk have been reverberating through markets and boosting the dollar. Walking back these remarks does not seem to help.

Investors are closely listening to the former Chair of the Federal Reserve, who seemed to contradict the message of her successor at the job, Jerome Powell. Yellen conditioned such a theoretical outcome on an increase in inflation, which she shrugged off as unlikely due to the fact that the government’s spending is relatively small to that of the broader economy.

She later said that it does not predict nor recommend raising rates and also said it is the Fed’s job, highlighting the bank’s independence. That only partially helped calm stock markets. While Yellen had occasional gaffes also in her previous role, some see her words as the first trial balloon ahead of a bigger move by the bank.

For EUR/USD, her words resulted in an initial fall below 1.2050, followed by a dip under 1.1990 – a critical separator of ranges and hitting a three-week trough. Traders have little time to recover as top-tier figures are due out shortly.

ADP’s jobs figures for April are set to show an increase in private-sector employment. A level close to one million positions gained would raise expectations toward Friday’s official Nonfarm Payrolls figures. However, it is essential to remember that the correlation between the two statistics has been uneven.

US ADP Employment Change: Caution surfaces in manufacturing

The second release is the ISM Services Purchasing Managers’ Index, which is set to remain above 60 points – indicating a robust expansion. Updated estimates could be lower after the disappointing Manufacturing PMI earlier this week. The employment component will be closely watched.

US ISM Services PMI April Preview: Inflation readings remain key as recovery gains strength

On the other side of the Atlantic, Europe’s vaccination campaign continues picking up steam, with most countries having surpassed the 25% mark of their populations vaccinated. The efforts are bearing fruit, with Germany benefiting from a lower incidence rate of COVID-19.

Nevertheless, an exit from the crisis is already priced into the euro and speculation about the Fed’s moves has more say. That could keep pushing the pair lower.

EUR/USD Technical Analysis

The breach of 1.1990 is yet to be confirmed, but it is significant. Euro/dollar broke above that level in mid-April and remained above it – making it a clear separator of ranges. However, now it is beginning to crumble, a bearish sign. Moreover, momentum on the four-hour chart has turned to the downside and EUR/USD lost the 100 Simple Moving Average (SMA)

Below 1.1990, the next lines to watch are 1.1945 and 1.1925, dating back to earlier in the spring. Further below, 1.1860 is the target.

Some resistance is at 1.2015, which held euro/dollar from falling. It is followed by 1.2055, which provided support late last month. Next up, 1.2075 and 1.2120 are eyed.