- GBP/USD has been under pressure as markets worry about jitters in the global recovery.

- Uncertainty around the BOE and elections in Scotland could keep sterling depressed through Thursday.

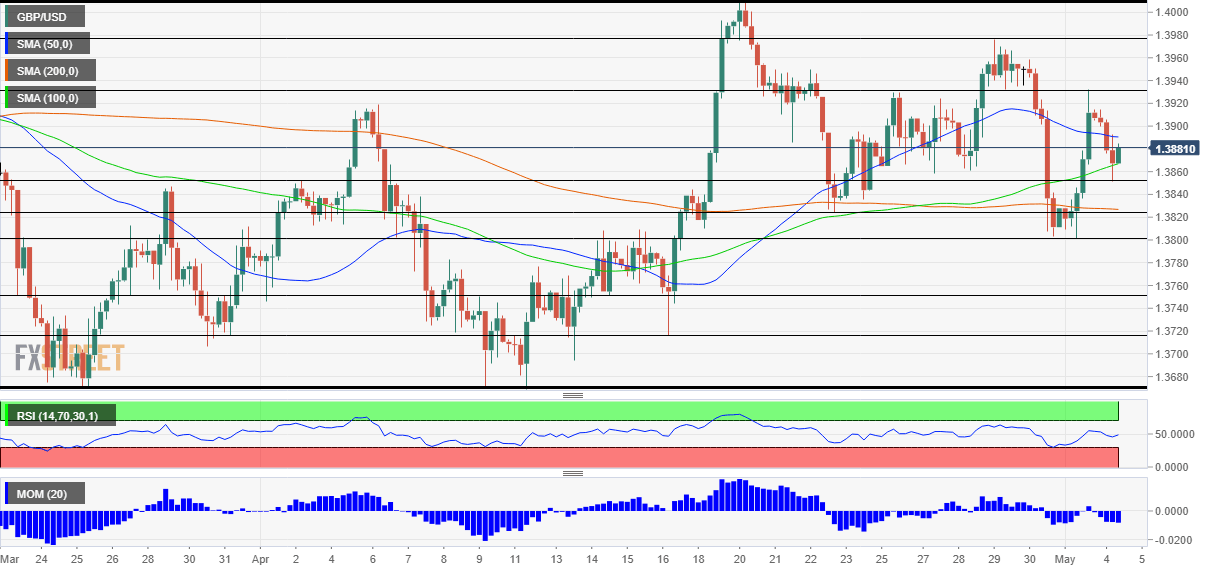

- Tuesday’s four-hour chart is showing bears are gaining ground.

“Patchy” – is how Jerome Powell, Chair of the Federal Reserve, has described the US economic recovery, pouring some cold water on investors’ enthusiasm. He also added that people at the lower end of the income ladder are still struggling with high unemployment levels.

The upswing in the world’s largest economy – led by a rapid vaccination campaign and fiscal stimulus – is also running into supply issues. The ISM Manufacturing Purchasing Managers’ Index unexpectedly dropped in April, mostly due to price rises and delays in shipments. While these are “good problems” to have – rather than lack of demand – markets are more cautious and money is flowing to the safe-haven dollar.

On the other side of the pond, the UK and France are still at loggerheads over fishing, bringing Brexit back to life. More importantly, uncertainty is growing around local and regional elections due on Thursday. Prime Minister Boris Johnson has been under pressure due to several scandals and needs a victory in a by-election in Hartlepool and other places to give him some political breathing space.

Perhaps the most important poll is in Scotland, where the Scottish National Party (SNP) may clinch an absolute majority, bringing the topic of Scottish Independence back on the table. Results will be known only on Friday morning and the pound could suffer until then.

Another source of uncertainty is the Bank of England’s “Super Thursday” event on Thursday as well. Will Governor Andrew Bailey and his colleagues hint they would taper bond buys soon? While the Fed refrained from that, the Bank of Canada already took that path. Given Britain’s quick immunization effort, such a move cannot be ruled out. Tapering would be positive for sterling, but nothing is certain until the BOE releases its announcement in two days’ time.

All in all, nervous traders could keep the pressure on GBP/USD on Tuesday and on Wednesday.

GBP/USD Technical Analysis

Pound/dollar has failed to recapture the 50 Simple Moving Average on the four-hour chart and struggles with the 100 SMA. Moreover, momentum is to the downside, adding to the bearish bias.

Support awaits at 1.3855, the daily low, followed by 1.3825, which is where the 200 SMA hits the price. Further down, 1.38 and 1.3750 are awaited.

Resistance is at 1.3930, which is the weekly high, and then by 1.3980 and 1.4010.