- EUR/USD has been edging lower after weak German GDP and rising US yields.

- America’s outperformance may cause further falls for the currency pair.

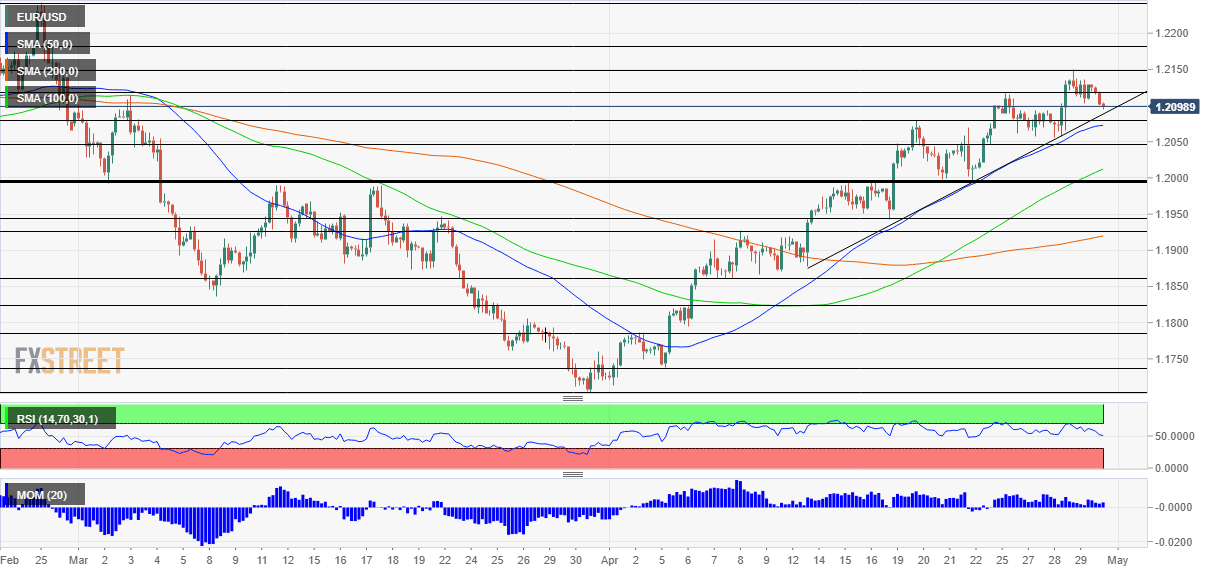

- Friday’s four-hour chart is still pointing to further gains.

EUR/USD has taken one step down, is it time for two steps up? That has been the pattern throughout April and technicals suggest that the currency pair could resume its gains. However, there are reasons that this fall could be different, perhaps more profound.

First, Friday is the last end of the week and also the final day of April, and that means that money managers may be adjusting their portfolios. At current levels, the currency pair is some 400 pips off the levels at the beginning of the month, implying room for a downward correction.

Second, the bearish bias around the dollar – a result of the Federal Reserve’s dovish decision – is fading. Jerome Powell, Chair of the Federal Reserve, said the US economy has “a long way to go” yet Gross Domestic Product figures from America point to strong momentum.

Apart from the as-expected 6.4% annualized gain, components such as a leap in investment and a drawdown in inventories point to an accelerated expansion in the second quarter. That is keeping the dollar bid.

US GDP Quick Analysis: Strong growth now, stronger even later, three reasons for the dollar to rise

Powell also described inflation as transitory and went a long way to explain that. Friday’s data dump includes the Core Personal Consumption Expenditure (Core PCE) which is the Fed’s preferred measure of price rises. An increase is on the cards. Moreover, Personal Spending and Personal Income are set to leap, owing mostly to stimulus checks.

US Personal Consumption Expenditure Price Index March Preview: Inflation is here

On the other side of the pond, optimism about Europe’s vaccination catch-up is beginning to be priced in. On the other hand, the old continent has a long economic recovery – the German economy shrank by 1.7% in the first quarter, worse than expected. When the eurozone’s “locomotive” slows down, the entire area shivers.

Overall, the slide from 1.2150 to 1.21 is probably not the usual “buy the dip” opportunity.

EUR/USD Technical Analysis

Momentum on the four-hour chart remains to the upside and the currency pair holds above the 50 Simple Moving Average (SMA). That is promising for the bulls.

Initial resistance awaits at the previous April high of 1.2117. It is followed by the monthly peak of 1.2150. Further above, 1.2180 and 1.2250 are eyed.

Support is at 1.2080, another swing high on the way up, and then by 1.2050 and the psychologically significant 1.20 level.

More Can the Fed keep US rates in check?