- EUR/USD has hit a two-month peak in response to the Fed’s dovish decision.

- US GDP figures are critical to the next moves.

- Thursday’s four-hour chart is showing that bulls are in control.

No taper – and therefore no tantrum in markets, but a positive mood that has been weighing on the safe-haven dollar and sending EUR/USD to 1.2150, the highest since late February. Traders have no time to rest before the next top-tier US event.

The Federal Reserve left its interest rate unchanged as expected in its April decision, and stressed that any pickup in inflation is transitory even though acknowledging the economic improvement. Reducing the pace of buying bonds from the current $120 billion/month was not even on the agenda – and that means further dollar devaluation.

Powell Analysis: The five dovish comments that down the dollar for longer

Jerome Powell, Chairman of the Federal Reserve, stressed that millions of Americans are out of work and that inflation is due to base effects and bottlenecks, which will likely be resolved. He also said the economy has a “long way to go.” Did he receive Thursday’s Gross Domestic Product figures in advance?

The economic calendar is pointing to a considerable annualized increase of 6.5% in US GDP in the first quarter of 2021. The year began with a harsh upswing of COVID-19, continued with a “deep freeze” storm but then turned around.

America’s vaccination campaign began kicking in and President Joe Biden’s massive $1.9 trillion stimulus deal came into effect in March, enough to impact growth figures. However, Disappointing Durable Goods Orders for March, published on Monday, somewhat dampened market expectations, and that may lead to a positive surprise.

US Q1 GDP Preview: Eyes on inflation and FOMC as economic recovery gathers steam

While there is a chance for GDP to fall short of investors’ expectations, the euro is well-positioned to take advantage of a minor miss in US data and may weather upbeat figures. The old continent’s vaccination campaign has picked up markedly and infections are falling. German and Spanish inflation figures are unlikely to ruin the rally, at least for now.

All in all, the broader trend is to the upside, but a short-lived correction cannot be ruled out.

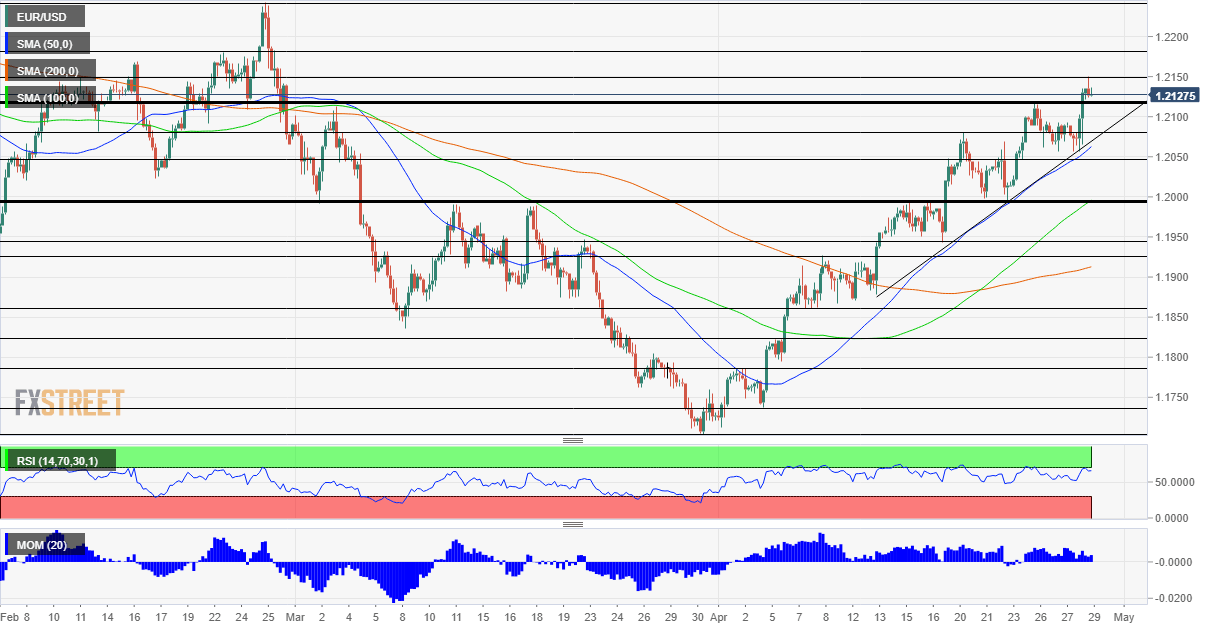

EUR/USD Technical Analysis

Euro/dollar is trending higher since bottoming out early in April. It has recently been trading above an uptrend support line that follows the 50 Simple Moving Average. Momentum remains to the upside and the Relative Strength Index (RSI) is below 70 – thus outside overbought conditions.

Overall, bulls are in the driver’s seat.

The fresh April high of 1.2150 is the immediate resistance line. It is followed by 1.2180 and 1.2240, levels last seen in February.

Support awaits at 1.2117, the previous April peak, and then by 1.2080, 1.2050 and 1.20, all stepping stones on the way up.