- GBP/USD has advanced after the Fed remained dovish.

- Political uncertainty in Northern Ireland, PM Johnson’s scandals, and US GDP are eyed.

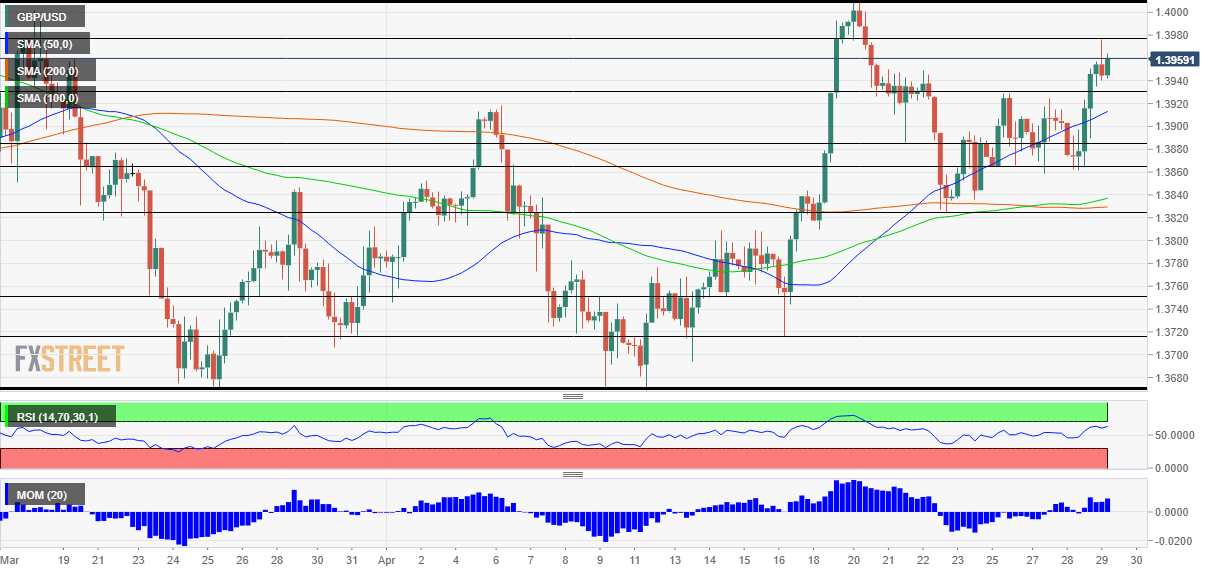

- Thursday’s four-hour chart is painting a bullish picture.

All boats have been rising with the tide created by the Federal Reserve – yet the pound’s positioning is probably not the best. The Federal Reserve stressed it is not about to taper down its bond buys anytime soon. More dollar printing means a weaker value for the greenback.

Jerome Powell, Chair of the Federal Reserve, said that rising inflation is due to base effects and bottlenecks, both of which are transitory. Regarding the economy, he repeated the mantra that the Fed will only raise rates once “substantial further progress” has been made. In any case, the economy “has a long way to go” according to the powerful central banker.

Powell Analysis: The five dovish comments that down the dollar for longer

How much progress has the economy made so far? Thursday’s first release of Gross Domestic Product figures for the first quarter are set to rock markets. If Monday’s Durable Goods Orders statistics for March are a guide, the data may fall short of estimates – an annualized 6.5% expansion – and could further weigh on the greenback. However, nothing is certain.

US Q1 GDP Preview: Eyes on inflation and FOMC as economic recovery gathers steam

How is the pound positioned? Probably poorly, or at least not as strong as it used to be. Britain’s successful vaccination campaign is already priced into sterling while new issues are still weighing on the currency.

First, Prime Minister Boris Johnson remains under pressure after reportedly asking Conservative Party donors to pay for the renovation of his Downing Street residence. Another publication, about preferring seeing “bodies pile up in the streets” than having another lockdown are also dogging the government and limiting its handling of the exit from the crisis.

Brexit also refuses to go away. Arlene Foster, leader of the Northern Irish Democratic Unionist Party, announced she would step down next month as handling the NI protocol has been proving difficult. The EU and the UK are still stuck in negotiations for implementing what has been agreed upon. Resolving issues related to the services sector has a long way to go as well.

All in all, fundamentals show sterling gains have their limits.

GBP/USD Technical Analysis

The four-hour chart is more upbeat for pound/dollar bulls. Momentum remains to the upside while the recent upswing has pushed cable above the 50 Simple Moving Average (SMA), while the Relative Strength Index (RSI) remains below 70 – outside overbought conditions.

Resistance awaits at 1.3980, which is the fresh swing high. It is followed by 1.4010, April’s peak, and then 1.4140, far in the distance.

Support is at 1.3930, which held GBP/USD back earlier this week. It is followed by 1.3880, 1.3860 and 1.3820.