- GBP/USD has been retreating from the highs as tension mounts ahead of the Fed decision.

- Any hint of tapering bond buys could send extend cable’s downtrend, but nothing is certain.

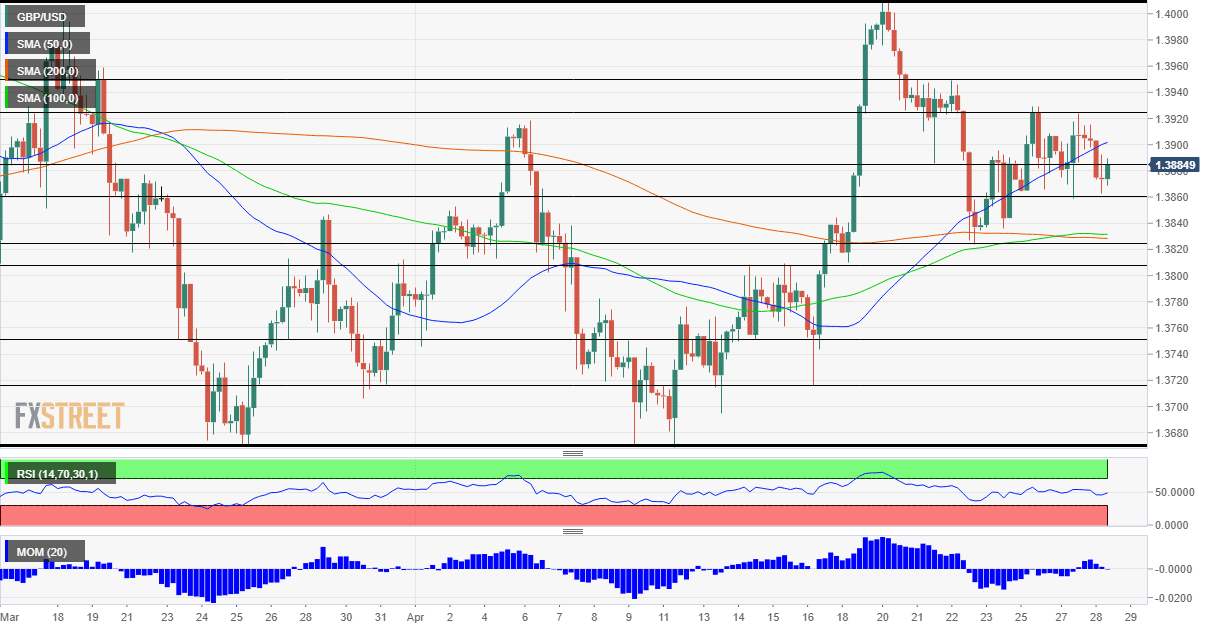

- Wednesday’s four-hour chart is painting a mixed picture.

Brexit, vaccinations, spending plans even Prime Minister Boris Johnson’s scandals are all put on the sidelines – it is Fed Day. The US Federal Reserve is set to leave its policy unchanged but will have to acknowledge the improving economic environment in the US.

Since the bank’s March meeting, vaccines and a massive $1.9 trillion stimulus plan have triggered a boom that is reflected in robust hiring, a pickup in inflation, a near 10% increase in retail sales and steaming hot business surveys.

Jerome Powell, Chairman of the Federal Reserve, insisted that any inflation in the spring would be transitory and stressed that 8.4 million Americans have yet to return to work. Will he stick to his guns? The Fed keeps interest rates at zero and foresees no change through 2024, while markets eye a move in 2022. The more burning question is bond buys.

Every month, the Fed creates $120 billion to purchase bonds on markets, keeping liquidity high and long-term borrowing costs lower. Before raising short-term rates, the Washington-based institution would gradually reduce its purchases – and it wants to avoid a 2013-style “taper tantrum.”

Will it succeed? Powell and his colleagues can kick off such a process by signaling they would lay out a plan for tapering in June. By then, they would have more data and publish new economic forecasts. If the Fed unleashes such a hint, GBP/USD would fall sharply.

On the other hand, if he keeps his steady course and refrains from any signals, sterling would soar.

- Federal Reserve Preview: Will Powell power up the dollar? Three things to watch out for

- US Federal Reserve Meeting April Preview: Buying time before the inevitable taper

How is the pound positioned? Johnson’s alleged comments of preferring “bodies piling up in the streets” over a lockdown, disagreements over the Norther Irish protocol – and the pricing of Britain’s successful campaign means sterling is vulnerable. In case markets are undecided about the Fed and the dollar’s direction, GBP/USD could fall while others hold their ground against the greenback.

The bias is bearish.

GBP/USD Technical Analysis

Pound/dollar has slipped below the 50 Simple Moving Average(SMA) on the four-hour chart, but it holds above the 100 and 200 SMAs. Upside momentum has disappeared, serving as another bearish sign. All in all, cable’s strength is diminishing.

Support awaits at the daily low of 1.3860, followed by 1.3820, a trough from last week and then by 1.3805 and 1.3750.

Resistance is at 1.3920, the peak on Tuesday, followed by 1.3950 and the all-important 1.40 level.