- GBP/USD has been rising as the safe-haven dollar retreats from its highs.

- Optimism about the NI protocol, Britain’s vaccine milestone and bullish BOE comments may boost sterling.

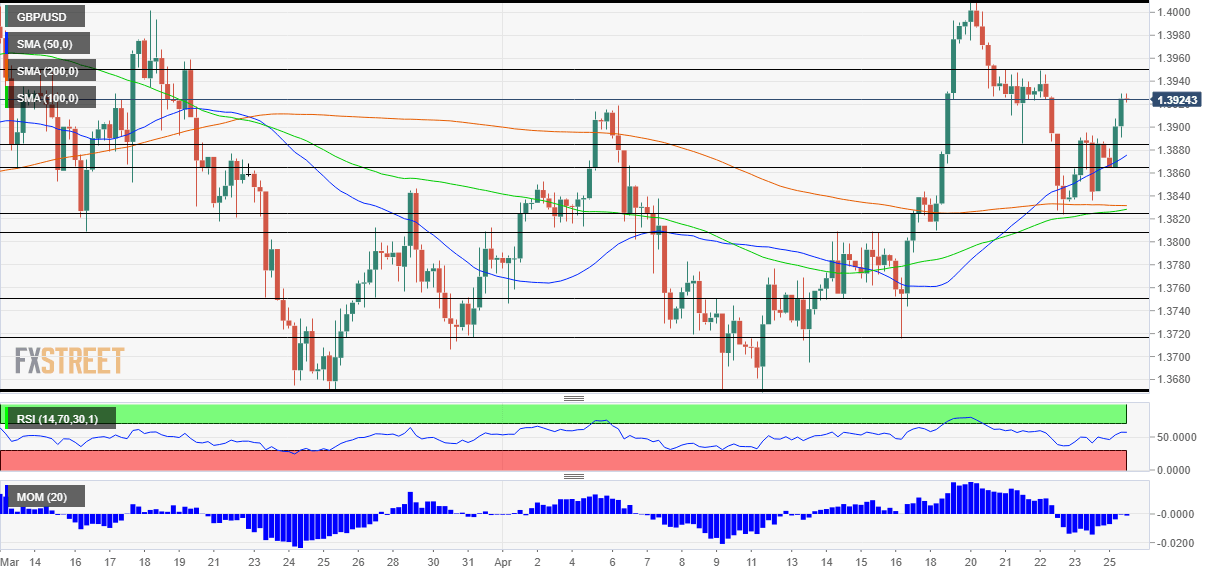

- Monday’s four-hour chart is pointing to more gains for cable.

Another day, another scandal for UK Prime Minister Boris Johnson, who allegedly said he would prefer seeing bodies pile up than impose a new lockdown – a claim Downing Street strongly denies. For sterling, Johnson’s Brexit actions matter more and they are pound-positive.

The EU and the UK are reportedly negotiating a quid pro quo deal on dealing with trade in Northern Ireland. Brussels has made new offers to London, potentially allowing for a breakthrough that could resolve issues and allow for more fluid commerce. While COVID-19 is the overwhelming economic issue, leftovers from Brexit remain a drag on the British economy and any progress could add another boost.

Sterling benefited from Britain’s rapid immunization effort, which hit a significant milestone – over 50% of the population received at least one jab. This headline, alongside the ongoing fall in cases, is helping the pound despite worries about India’s out-of-control covid situation. The UK, the US and other countries have offered aid – also of self-interest, as falling demand from Asia could hurt the global recovery.

Another reason to be bullish on the pound comes from the Bank of England. Deputy Governor Ben Broadbent said that he sees “very rapid” growth at least during the next couple of quarters. Will Britain’s bounce-back match America’s?

US Durable Goods Orders figures for March are due out on Monday, and economists expect a substantial increase of 2.5% after a fall in February. However, after the world’s largest economy’s statistics beat estimates in other releases, a faster growth rate cannot be ruled out. The publication feeds into Thursday’s Gross Domestic Product data and is also watched by the Federal Reserve.

The Fed is set to leave its policy unchanged and could begin laying the groundwork for reducing its bond purchases – something that would boost the dollar. However, the upbeat mood currently weighs on the greenback, which serves as a safe-haven currency.

All in all, fundamentals point to further upside, at least on Monday.

GBP/USD Technical Analysis

Pound/dollar has recaptured the 50 Simple Moving Average (SMA) on the four-hour chart and momentum has nearly flipped to the upside. The Relative Strength Index (RSI) is significantly below 70, thus far from overbought conditions.

Above the daily high of 1.3930, the next resistance line to watch is 1.3950, which held GBP/USD down last week. It is followed by 1.4010, the stubborn April high.

Support awaits at 1.3880, a swing high from last week, followed by 1.3860 and 1.3820.

More GBP/USD Weekly Forecast: Taper tantrum? Powell may push sterling off the cliff