- GBP/USD has been hovering around 1.3950 as markets are torn by mixed virus developments.

- The next dose of optimism has sterling well-positioned to gain.

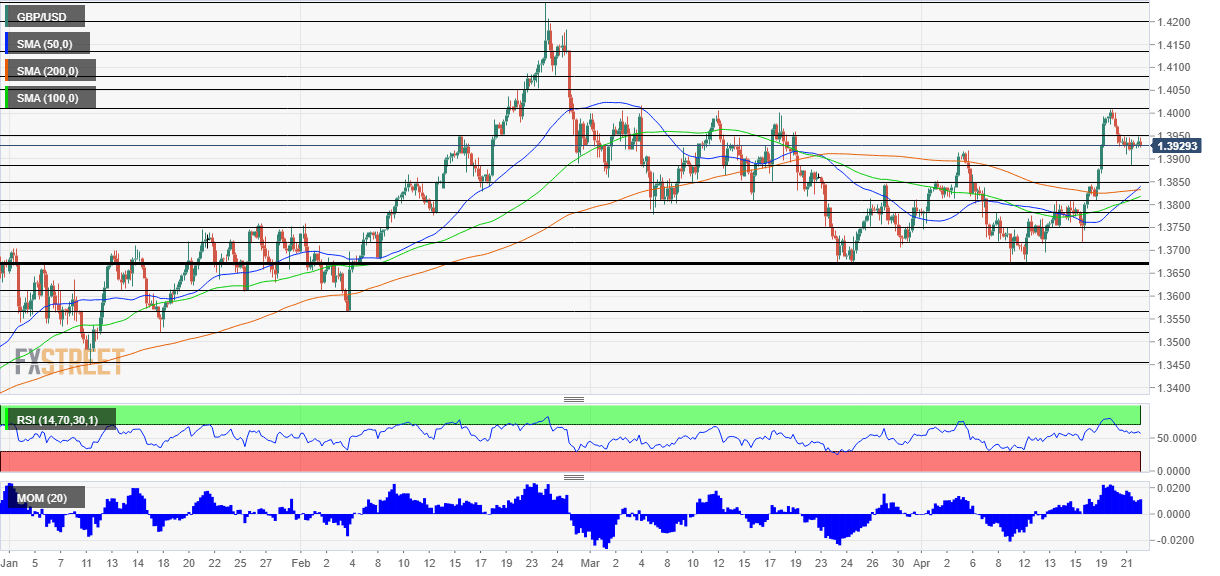

- Thursday’s four-hour chart is pointing to the upside.

Post-pandemic bloom or virus gloom? That is the question grappling markets as optimism about a vaccine-led recovery in the Western world contradicts horrific figures in India. Wednesday’s stocks rally weighed on the safe-haven dollar while the worrying news from India is boosting the greenback.

US Treasury yields rise from a six-week low has also kept the dollar bid. Will it last? The focus may easily shift back America’s economic boom, especially if US jobless claims refrain from leaping back to the previous higher. The decrease from levels above 700,000 to 576,000 last week was a welcome surprise and economists expect a consolidation of this improvement.

See US Initial Jobless Claims Preview: Optimism doesn’t come naturally

The market mood may improve also due to an improving virus situation in the US. After several weeks of increasing cases, the curve flattened and has begun turning down. As long as investors do not worry about slowing vaccination rates – partly due to the decision to suspend the usage of Johnson & Johnson’s jabs – shares have room to rise and the dollar could fall.

On the other side of the pond, sterling is well-positioned to take advantage of such a move. The UK is on the verge of reaching 50% of its population with at least one dose of immunization while infections, hospitalizations, and deaths are all declining.

All in all, the fundamental picture remains favorable for cable bulls.

GBP/USD Technical Analysis

Pound/dollar continues benefiting from upside momentum on the four-hour chart and trades well above the 50, 100 and 200 Simple Moving Averages. Moreover, the 50 SMA crossed above the 200 SMA, a bullish development.

Some resistance awaits at the daily high of 1.3950, followed by the fresh April peak of 1.4010. It is followed only by 1.4140, significantly higher.

Support is at this week’s swing low of 1.3880, followed by 1.3850 and 1.38.