- EUR/USD has kicked off the week on the back foot amid US inflation concerns.

- Worries about the virus’ spread in Europe is one of the reasons weighing on the euro.

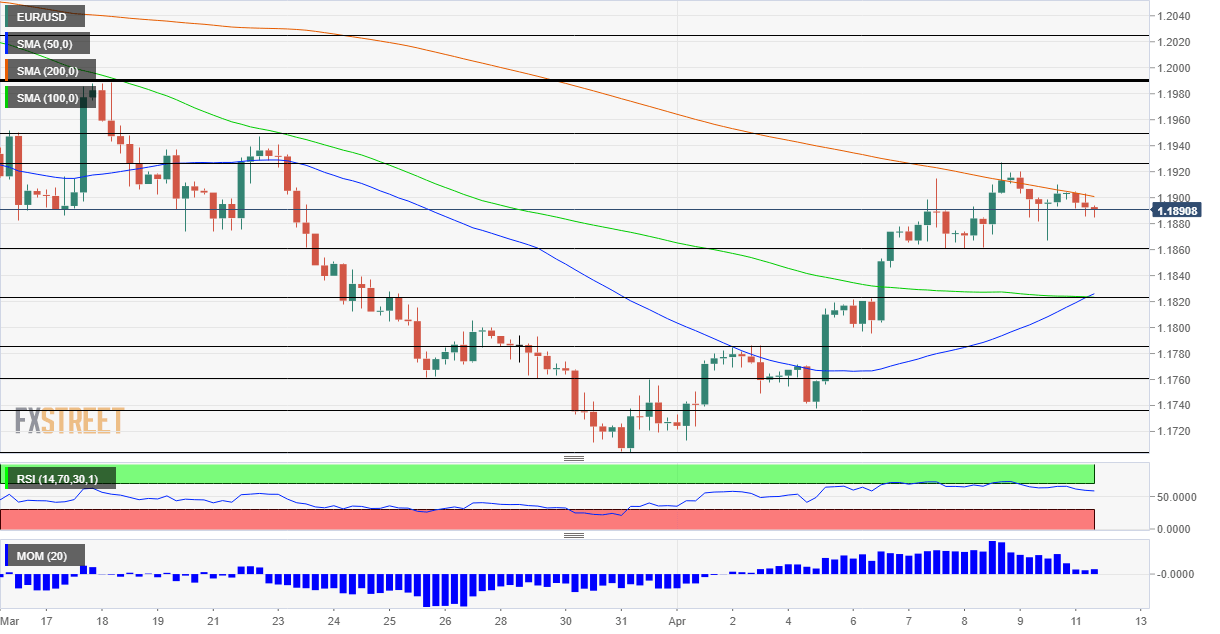

- Monday’s four-hour chart is painting a mixed picture.

At an inflection point – that is how Federal Reserve Chair Jerome Powell has described the economy, which is reopening rapidly and creating jobs amid America’s successful vaccination campaign – which provides the dollar advantage over the euro. Around 35% of Americans have received at least one shot, while the figure in Europe is below 20%.

The powerful central banker has also expressed worries that a rapid return to normal would allow the virus to spread and urged caution. While cases are rising in certain states, investors are more concerned about rising US inflation. Producer prices jumped in March by 1% monthly, double the expectations and beyond the expected “base effects.” Investors are repricing the chances that the Fed raises rates sooner than later.

Tension is now mounting toward Tuesday’s Consumer Price Index statistics. Economists expect annual inflation to rise in the coming months and uncertainty about its sustainability is what is driving the dollar.

More Dollar rally coming? Clarida’s clarity, powerful PPI, point to the Fed raising rates sooner

In the old continent, the European Central Bank has the opposite problem. Fabio Panetta, an Italian member of the ECB, said that the bank “must accept no further delay in lifting inflation.” The Frankfurt-based institution has ramped up its euro-printing scheme but governments are moving slowly with deploying fiscal support already agreed upon.

IIn the meantime, Europe’s covid situation remains worrying, albeit not worsening. Italy is mulling lifting some restrictions in May while infections in Germany are stabilizing.

Nevertheless, even if the old continent is making some headway against the virus and jabbing its population at a faster rate, vaccines may prove less effective than previously thought. A study in Israel has shown that Pfizer’s immunizations provide less protection against the South African variant of the virus. Such worries may boost the safe-haven dollar.

All in all, the dollar has room to gain ground and cause a “course-correction” after a bullish beginning to April.

EUR/USD Technical Analysis

Euro/dollar has been consolidating its gains, as shown by the four-hour chart. The currency pair is still benefiting from upside momentum, but that is subsiding and it has been unable to surpass the 200 Simple Moving Average. However, EUR/USD continues trading above the 100 and 200 SMAs.

Support awaits at 1.1860, which cushioned it late last week. It is followed by 1.1820, which is where the 100 and 200 SMAs converge. Further down, 1.1785 and 1.1760 await the pair.

Resistance is at the April high of 1.1925, followed by 1.1950 and 1.1990, lines that were last seen in March.

Bank to the Future: Interest rates return to market center stage