- EUR/USD has staged a recovery on upbeat vaccine and growth forecasts.

- Concerns about eurozone immunization supplies and a tad of Fed hawkish may change the picture.

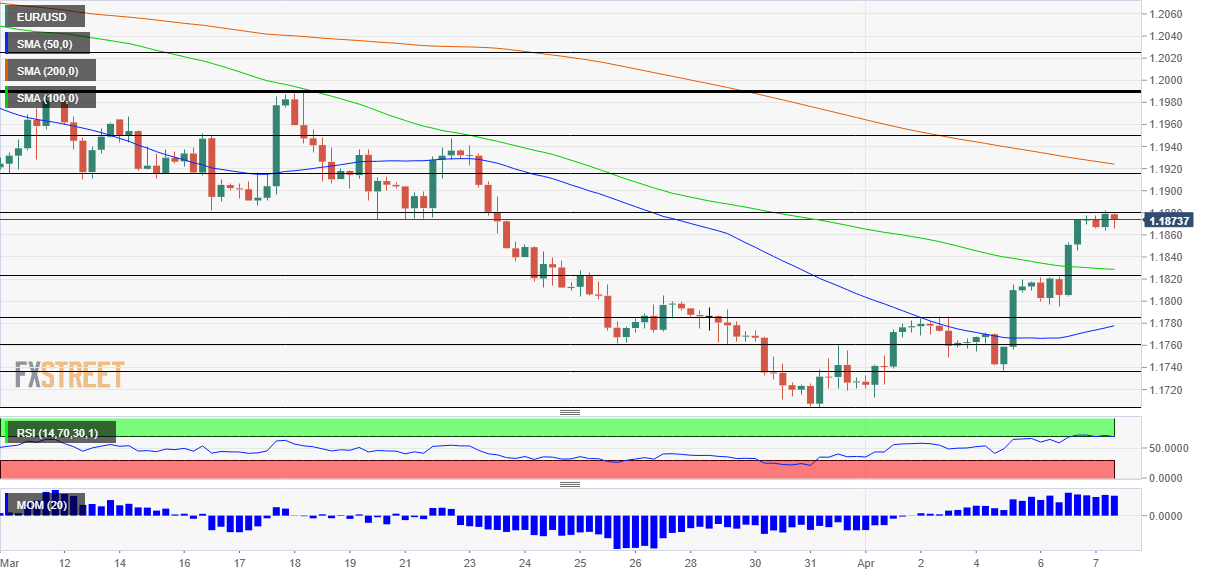

- Wednesday’s four-hour chart is showing the currency pair is in overbought territory.

Even before the summer – that is when most Europeans may get a COVID-19 vaccine, according to new estimates. The EU has upgraded its projections for getting its population inoculated amid promising supply estimates. Earlier, prospects for reaching a majority stood at September rather than late June.

The upbeat vaccine forecasts from the bloc joined an upgrade to economic ones from the International Monetary Fund. The IMF lifted global growth estimates to 6%, and that included upgrades to eurozone countries. Finally, some good news for the euro.

While these developments boosted the euro, the dollar suffered from falling safe-haven flows. President Joe Biden brought forward his goal of offering inoculations to all Americans from May 1 to April 19. Most states are already making appointments to get vaccinated for everybody over 18. The drop in US Treasury yields dragged the greenback down with it.

Can this bullish EUR/USD last? Markit’s Services Purchasing Managers’ Index for Spain came out better than expected, but that is insufficient to maintain the trend.

On the other hand, concerns about vaccines have come back to the fore. Moderna, one of the jab providers, told Germany that it is forced to delay the next shipment of vaccines – extending the trend of postponements from all pharmaceuticals.

Moreover, the EU’s immunization programs heavily on AstraZeneca’s inoculations, and it is unlikely that all Europeans will take it up. The European Medicines Agency (EMA) is set to provide an update on the potential correlation with blood clots. In the UK, the company’s trial with children has been halted.

Another factor that could push EUR/USD lower comes from the US. The Federal Reserve is set to release the meeting minutes from its latest rate decision and it may show growing optimism. Investors may interpret an upbeat message as a subtle hint that borrowing costs are set to rise sooner rather than later – boosting the greenback.

See FOMC Minutes March 16-17 Preview: Growth without inflation?

Moreover, the recent drop in US bond yields is unlikely to last after a series of upbeat figures, from the Nonfarm Payrolls, through the ISM Services PMI and finally with JOLTs.

All in all, the currency pair’s bounce may have gone too far.

EUR/USD Technical Analysis

Euro/dollar has turned higher, but a quick look at the four-hour chart. Momentum is to the upside but the Relative Strength Index is just around 70 – flirting with overbought conditions. The currency pair is trading above the 50 and 100 Simple Moving Averages but below the 200 SMA.

Resistance awaits at 1.1880, the daily high, followed by 1.1920, which provided support in mid’March. The next lines to watch are 1.1920 and 1.1950.

Support is at 1.1820, which capped EUR/USD on the way up, followed by 1.1780, 1.1760 and 1.1740.