- EUR/USD has been able to recover amid a cheerful start to the second quarter.

- Robust US jobs figures and low liquidity may send the dollar sharply higher.

- Europe’s virus issues heavily weigh on the common currency.

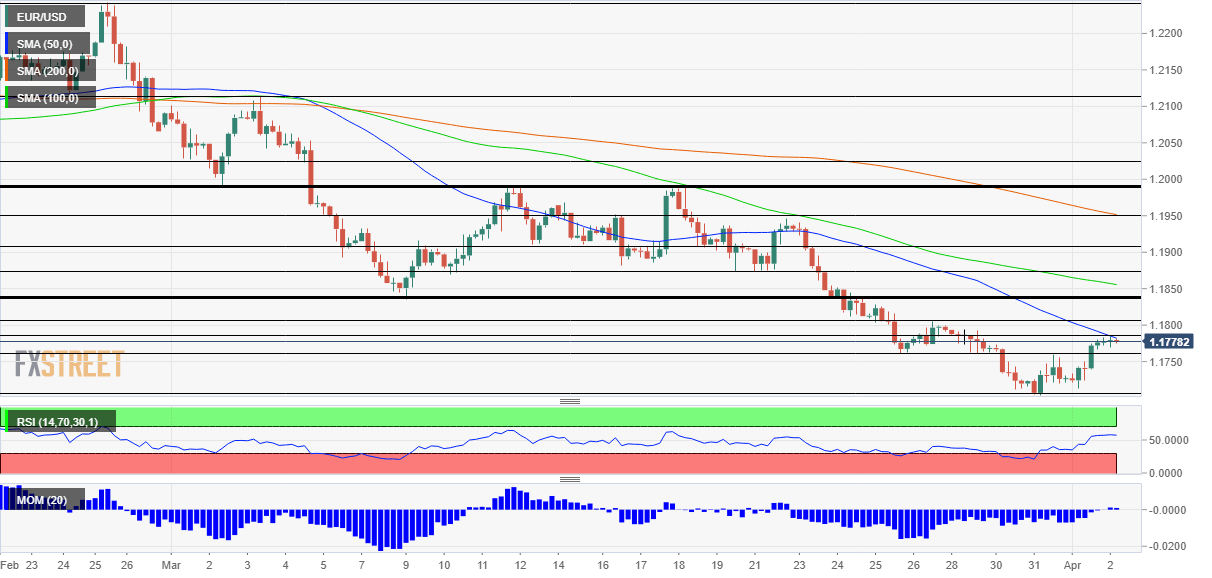

- Friday’s four-hour chart is showing bears remain in the lead.

All the gauges are flashing green – FXStreet’s Leading Indicators checklist for March’s Nonfarm Payrolls report are pointing to a positive outcome, and that may boost the dollar. The economic calendar is pointing to an increase of over 600,000 jobs last month, which would be the highest since October. However, it could be even higher.

The ISM Manufacturing Purchasing Managers’ Index shot up to 64.7 – the highest since 1983 and a sign of robust activity in America’s industrial sector. This forward-looking survey included a leap in the employment component. The mix of optimism around vaccines, reopening in several states, and stimulus checks have all contributed to hiring. The question is how much. Some analysts foresee a leap of over one million jobs, but that could be over the top.

These all-important labor market statistics are published on Good Friday, a holiday in many parts of the world. Trading volume is limited and the lack of liquidity could result in significant moves.

- US Nonfarm Payrolls March Preview: Optimism and evidence this time?

- Nonfarm Payrolls Preview: Five reasons why hiring is set to skyrocket, dollar may follow

Leading toward this all-important release, the dollar has been on the defensive despite apparent economic strength in the US. Treasury yields remain in the driver’s seat and they dropped after President Joe Biden presented his massive $2.25 trillion infrastructure spending plan. Why?

First, funding for this expenditure is set to come from tax hikes, therefore lessening the need for more debt issuance. With fewer bonds circulating, they are worth more – and the result is lower yields and therefore a weaker dollar. Secondly, Republicans are opposed to the scheme and Congress may substantially modify Biden’s plan.

That dynamic may change if prospects of robust recovery raise inflation expectations and force the Federal Reserve to act sooner than later, and contrary to its current pledge. The next adjustment in markets depends on the NFP.

Moreover, if there is one currency the dollar has more to run against, it is the euro. Good Friday is a somber event in most of the old continent, which is under various forms of lockdowns. COVID-19 is raging in Europe and while vaccinations have picked up, they have reached roughly 12% of the population, in comparison to around 30% in the US and nearly half of Britain’s citizens.

And if the Fed may raise rates in America due to higher inflation, the European Central Bank is far away from such a move. The Core Consumer Price Index disappointed with 0.9% annual in March, lower than expected and reflecting weakness.

All in all, the tables remain tilted in favor of the dollar and against the euro.

EUR/USD Technical Analysis

Euro/dollar has been able to reach levels last seen on Monday, but it remains on a downtrend as the four-hour chart clearly shows. Momentum and the Relative Strength Index are balanced while EUR/USD remains capped by the 50, 100 and 200 Simple Moving Averages. Overall, bears are in the lead.

Support is at the daily low of 1.1770, followed by 1.1760 and the psychologically significant 1.17. Further down, 1.1630 is the downside target.

Some resistance awaits at the daily high of 1.1785, followed by 1.1805, 1.1835 and 1.1875.

More Armageddon has been postponed: Cryptocurrencies and market realities