- EUR/USD has been struggling as France enters a lockdown and covid rages through all of Europe.

- US data and reactions to Biden’s infrastructure plan may boost the dollar.

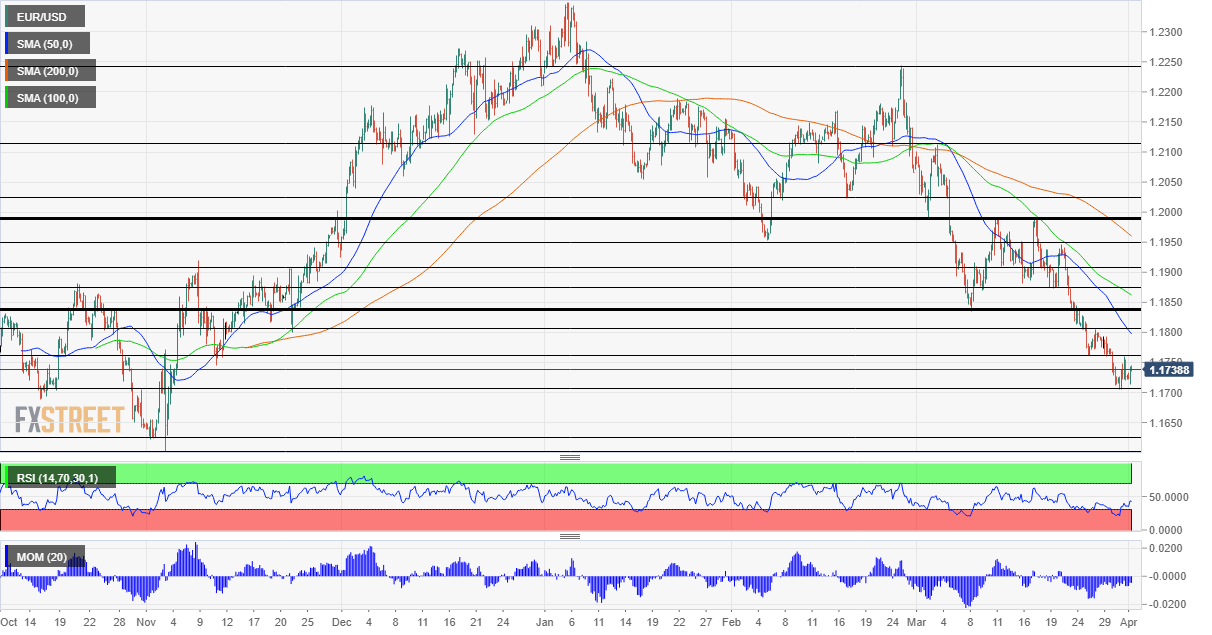

- Thursday’s four-hour chart is pointing to further falls for the currency pair.

Euro bears are not taken for a ride on April Fool’s Day – the common currency remains under pressure and for worrying reasons. Coronavirus cases continue rising in the old continent and the threat of overwhelming France’s health system caused President Emmanuel Macron to impose a monthlong lockdown. His move joins Italy, Germany and other countries.

The old continent is bracing for further pain from the virus, especially as lags behind in vaccinations. While the pace of immunization is set to accelerate, only around 12% of the population received one jab and a manufacturing issue at Johnson & Johnson’s US factory may cause even more delays.

EUR/USD has been holding up above 1.17 as US yields retreat from their highs. One of the reasons for the calm is that US President Joe Biden presented his massive $2.25 trillion infrastructure spending plan along with a funding scheme – tax hikes are coming. While higher rates for corporates may weigh on Wall Street, it means less debt issuance, which is positive for bonds. The resulting drop in yields weighs on the greenback.

Two critical data points are eyed on Thursday, and they may push the dollar higher. First, weekly jobless claims are set to continue falling, after hitting 684,000 last week – the lowest since the pandemic.

US Initial Jobless Claims Preview: Market lose interest in layoffs

Secondly, the ISM Manufacturing Purchasing Managers’ Index for March is set to extend its gains above 60 – reflecting the rapid growth in America’s industrial sector. Any score above 50 represents expansion.

ISM Manufacturing Purchasing Managers’ Index March Preview: Consumer confidence reinforcement

Both figures serve as a hint toward March’s Nonfarm Payrolls report due out on Good Friday. Economists project a substantial boost to employment, reflecting an acceleration. The mix of upbeat data and low liquidity could be explosive for the dollar.

Final Manufacturing PMIs in Europe were also upbeat, but they are heavily overshadowed by the shuttering in the old continent.

See Nonfarm Payrolls Preview: Five reasons why hiring is set to skyrocket, dollar may follow

All in all, after EUR/USD stabilized at lower ground, it may be ready to resume its falls.

EUR/USD Technical Analysis

Euro/dollar continues suffering from downside momentum on the four-hour chart and remains suppressed below the 50, 100 and 200 Simple Moving Averages. Moreove, the Relative Strength Index has risen above 30 – leaving oversold territory and allowing for more falls.

The round 1.17 level provided support earlier this week and remains critical support. It is followed by 1.1630, 1.16 and 1.1550, all dating back to the autumn of last year.

Some resistance awaits at 1.1745, the daily high, with the more substantial cap looming at 1.1760. The next levels to watch are 1.1805 and 1.1836.