- GBP/USD has turned higher as the dollar takes a breather from gains.

- Britain’s vaccination campaign and upgraded GDP support sterling.

- Wednesday’s four-hour chart is pointing to further gains.

Rising from a better spot – a higher low is everything technical traders need to know to conclude that GBP/USD has turned a corner and is on the way up. This price action has its backing in fundamentals.

The most recent piece of good news from the UK was the upgrade of Gross Domestic Product statistics for the fourth quarter of 2020 – 1.3% against 1% originally reported. However, the primary driver for sterling’s success is Britain’s rapid vaccination campaign – which is bearing fruit.

Contrary to continental Europe – and also the US, despite its fast jabbing – COVID-19 cases and deaths are falling in the UK. That allows the government to proceed in its reopening program, and hopefully not have to unwind it.

On the other side of the pond, the US dollar has taken a breather from its gains as Treasury yields are off the highs. One of the drivers for the cooling in the bond sell-off comes from details of President Joe Biden’s infrastructure plan. The Commander in Chief plans to raise taxes to fund his grand $2+ trillion expenditure, which implies less debt issuance, thus higher values for bonds – lower yields which are negative for the dollar.

However, the strength of the US economy – even before Congress gets to debate the plan – continues supporting the greenback. The Conference Board’s Consumer Confidence gauge shot to 109.7 points in March, smashing estimates. ADP’s labor report is set to show an increase of over half a million jobs.

ADP Private Payrolls March Preview: Consumers look to an early spring?

All in all, the balance on the dollar has tilted to the downside, while sterling remains upbeat. That may allow cable to extend its gains.

GBP/USD Technical Analysis

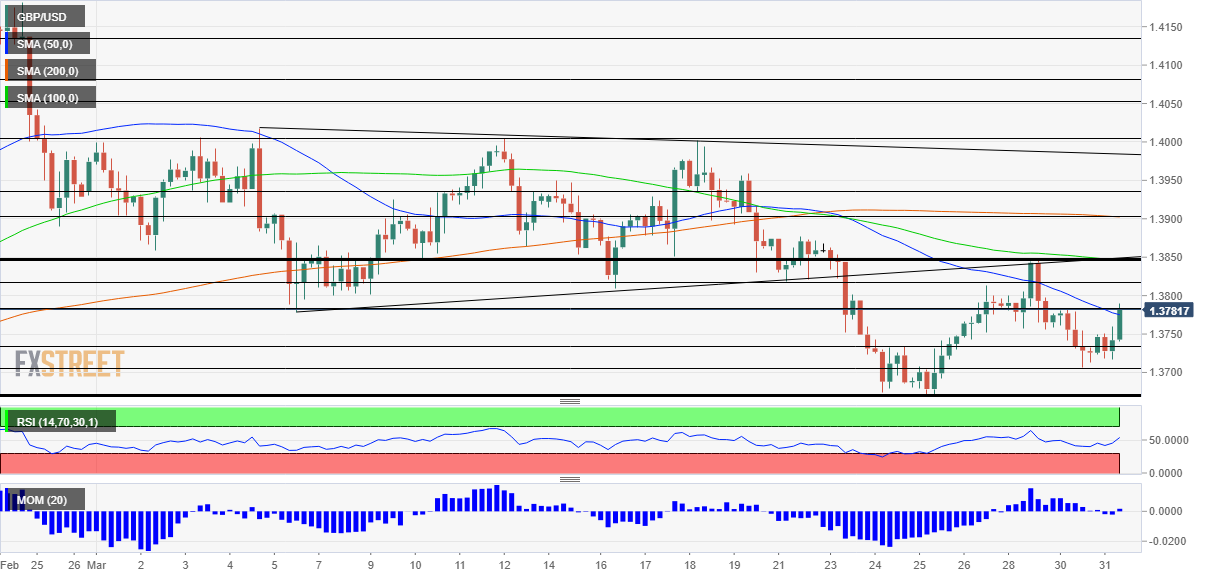

The four-hour chart is pointing to higher lows, as mentioned earlier. Pound/dollar bottomed out above 1.37 and crossed the 50 Simple Moving Average on its way up, while flipping momentum to the upside. All in all, bulls are gaining ground.

Cable is still battling 1.3780, which was a support line in early March. It is followed by 1.3820, a swing high that was seen last week, followed by 1.3850, a high point early in the week and where the 100 SMA hits the price.

Support awaits at 1.3735, which capped GBP/USD last week. It is then followed by 1.37 and finally by 1.3670, the March low.