- GBP/USD has been advancing amid some calm on the vaccine front and upbeat UK retail sales.

- Concerns about the virus and the Suez Canal blockage could keep the dollar bid.

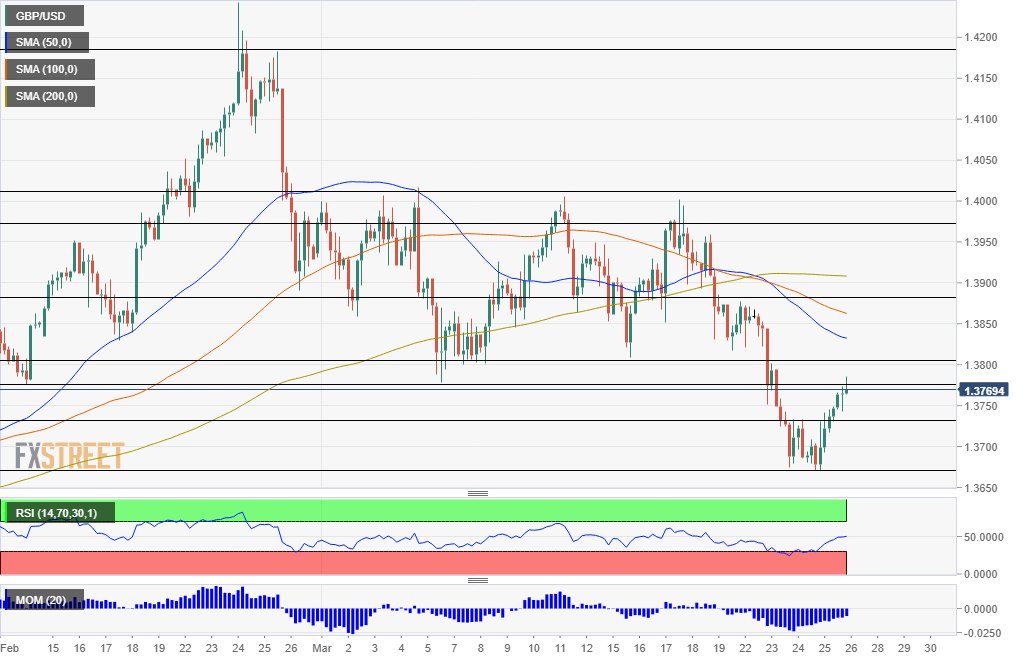

- Friday’s four-hour chart is pointing showing bears are still in the lead.

The days are becoming longer and Easter is around the corner – yet several upbeat British developments may fail to keep sterling bid amid growing global worries on multiple fronts. While the pound may beat the euro, it may succumb to the dollar.

Three positive developments boost sterling. First, the UK is pushing through with the next phase of reopening the economy amid its successful vaccination campaign. The government’s move does not face pushback from the medical community nor the opposition.

Second, UK Retail Sales jumped by over 2% in February, showing the resilience of the economy just before the first phase of the reopening. It adds to the narrative that Britain is starting to recover from a strong base.

Third, EU leaders have toned down their rhetoric and seem reluctant to slap vaccine export bans – which threatened to derail the UK’s immunization campaign. However, this is also where potential troubles could begin – the bloc’s members also gave Brussels the authority to stop shipments and tensions remain high amid growing frustration about the EU’s sluggish vaccination campaign. AstraZeneca will likely remain in the news.

GBP/USD’s rise also stems from a better market mood, which can be partially attributed to America’s rapid inoculation campaign. President Joe Biden pledged 200 million doses in his first 100 days in office, raising hopes that the world’s largest economy would get back on its feet sooner and drag the entire world higher. The drop in US jobless claims to the lowest levels in a year also contributed to optimism.

However, COVID-19 infections are rising in the US With 26% of the population vaccinated, the battle against the virus is far from over. Moreover, Friday’s Personal Spending and Personal Income figures for February will likely be more subdued, potentially dampening the mood.

The February Grab-Bag Preview: Personal Income, Spending, Core PCE Prices

Another factor causing concern is the blockage of the Suez Canal by a stranded mega-ship. Several companies have already diverted vessels around Africa, bumping up costs for deliveries and disrupting global supply chains.

Global markets are positioned for a robust recovery, but where is the proof?

All in all, investors have several worries that could boost the dollar.

GBP/USD Technical analysis

Bears have been ceding some ground but remain in control. Momentum on the four-hour chart remains to the downside despite an improvement and the currency pair continues trading below the 50, 100 and 200 Simple Moving Averages.

Resistance awaits at 1.38, which provided support in mid-March, followed by 1.3875, a separator of ranges. Further above, 1.3975 and 1.4010 are eyed.

Some support awaits at 1.3775, a former double-bottom, and it is followed by 1.3740 and 1.3670, the latter being the March trough.