- GBP/USD has been tumbling down amid a worsening market mood and weak UK data.

- The results of Britain’s vaccine clash with the EU may determine the next moves.

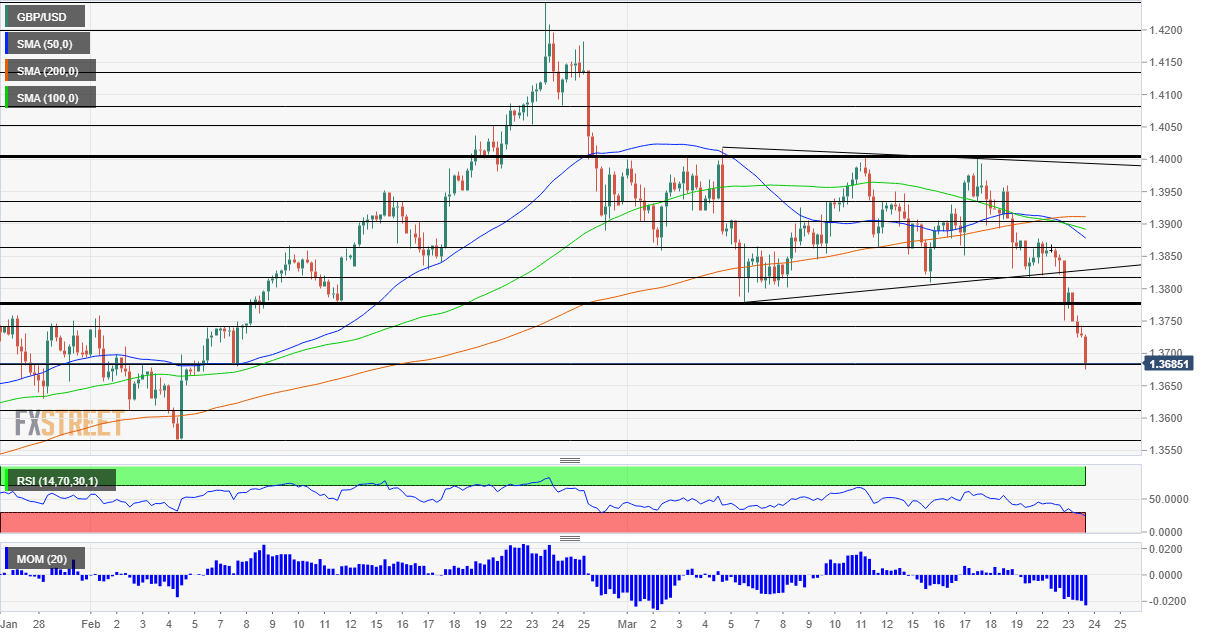

- Wednesday’s four-hour chart is pointing to oversold conditions.

If I don’t vaccines, nobody does – that seems to be the EU’s approach to doses of the solution to the covid crisis, and that may hurt Britain. Brussels is drafting rules that may not only limit exports of inoculations but also raw materials, potentially disrupting the manufacturing of both AstraZeneca’s vaccines and Pfizer’s.

Ahead of an EU Summit on Thursday, UK Prime Minister Boris Johnson is trying to soothe tensions and find a compromise that would allow Britain to continue its successful campaign. Concerns about a halt to jabbing are weighing on sterling and a solution could help it recover.

However, other factors are beyond the PM’s influence. The Consumer Price Index rose by only 0.4% in February, missing estimates and potentially pushing back any future rate hikes by the Bank of England. That comes after a mixed jobs report on Tuesday.

In the US, price rises are also high on the agenda. Jerome Powell, Chairman of the Federal Reserve, said that inflation may rise in the coming months, but is unlikely to become persistent. He reiterated his pledge to support the economy, especially as around 9.5 million Americans are out of work.

Treasury Secretary Janet Yellen also vowed to assist the recovery but remained mum on the administration’s potential infrastructure plans. According to reports, President Joe Biden’s advisors are mulling a whopping $3 trillion expenditure spree – but this time one that would be partially funded by tax hikes.

Why the dollar is rising while yields are falling, blame it on the taxman

Pushing rates that corporations pay to the upside is contributing to the damp mood and to flows into the safe-haven dollar. However, it also implies less issuance of bonds – and that explains the simultaneous decline in yields and the rise in the dollar. This new correlation may persist.

Yellen and Powell will testify again on Wednesday and other Fed officials will also speak. Investors will also be eyeing investment figures – Durable Goods Orders statistics for February are forecast to show increased expansion.

US Durable Goods February Preview: Consumption to reflect labor market recovery

All in all, dollar strength and vaccine concerns have knocked cable lower, but if jitters related to jabs subside, sterling has room to recover.

GBP/USD Technical Analysis

Pound/dollar has broken below the double-bottom at 1.3775 and uptrend support. It also suffers from downside momentum on the four-hour chart. However, the Relative Strength Index has dropped below 30 – entering oversold conditions and implying a bounce.

Cable is battling the 1.3680 level which provided support in February. Further down, the next levels to watch are 1.3610 and then 1.3565, both working as cushions around the same time.

Some resistance is at 1.3745, a temporary cap from February, and then the strong 1.3775 level mentioned earlier. Further above, 1.3820 is the level to watch.