- EUR/USD has been under pressure as US yields hold high ground.

- Rising European covid cases, trouble in Turkey and some Fed hawkishness are weighing on the pair.

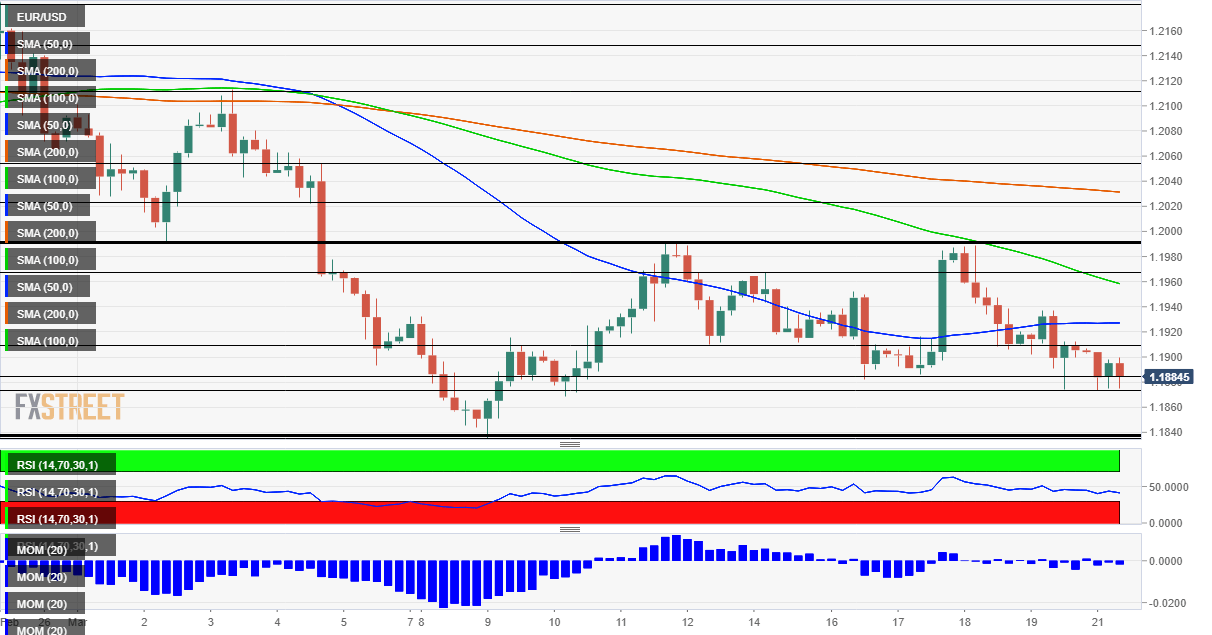

- Monday’s four-hour chart is showing bears have the upper hand.

Spring is here – but Europeans’ Easter and also summer holidays are in danger and that is weighing on the euro. The dollar is not letting go either.

Rising coronavirus cases in Germany have prompted Chancellor Angela Merkel to suggest a four-week extension to the nationwide lockdown. Europe’s largest economy would be joining France, which imposed new restrictions on around 20 million citizens. Most of Italy has gone silent amid a new shuttering.

The EU is far behind the US and the UK in its vaccination campaign and frustration has not only led to protests, but also to potential blocking of vaccine exports. Brussels is set to prevent AstraZeneca doses made in the Netherlands from crossing the Channel to Britain, amid growing acrimony.

Officials are set to review all outgoing shipments, claiming the pharmaceutical firm has not fulfilled its obligations to the bloc. However, many Europeans remain hesitant about Astra’s inoculation after last week’s blood clot scare. So far, EU countries administered 13 doses for every 100 citizens while the US is at 38.

Pressure on the euro from the northwest – vaccine exports to the UK – joins issues to the bloc’s southeast. Turkey’s President Recep Tayyip Erdogan sacked the governor of the central bank, causing a downfall in the lira and sending shockwaves in other places. The safe-haven dollar is receiving some demand.

Moving to the US, the Federal Reserve announced it is ending a pandemic-era exemption to banks on Friday, boosting the greenback. The expiry of the SLR is set to trigger a sell-off in US bonds, further raising yields.

That SLR move was partially priced in and seems to have subsided, but Treasury yields remain central to the greenback’s movements. Jerome Powell, Chairman of the Federal Reserve, is set to speak on Monday in the first out of three public appearances. If he continues dismissing rising returns on US debt, the dollar may continue rising.

One of the main upside drivers of yields is President Joe Biden’s massive $1.9 trillion covid relief program – and the White House is already mulling new plans. According to reports from Washington, the new program will likely consist of infrastructure spending and also tax hikes. While higher revenue for the government means less debt issuance, a potential market-unfriendly move could weigh on stocks and boost the safe-haven dollar.

All in all, the dollar has reasons to rise while the euro is under growing pressure.

EUR/USD Technical Analysis

Euro/dollar is trading below the 50, 100 and 200 Simple Moving Averages on the four-hour chart and suffering from downside momentum.

Some support awaits at 1.1890, which is the daily low, and the next line to watch is already the 2021 trough of 1.1836. Further down, 1.18 and 1.1750 – levels that were last seen in 2018 – come into play.

Some resistance is at 1.1910, which provided support last week. It is followed by 1.1965 and by the double-top of 1.1990.