- GBP/USD has been falling in a counter-reaction to the dovish Fed decision.

- The BOE may provide an upbeat outlook and boost the pound.

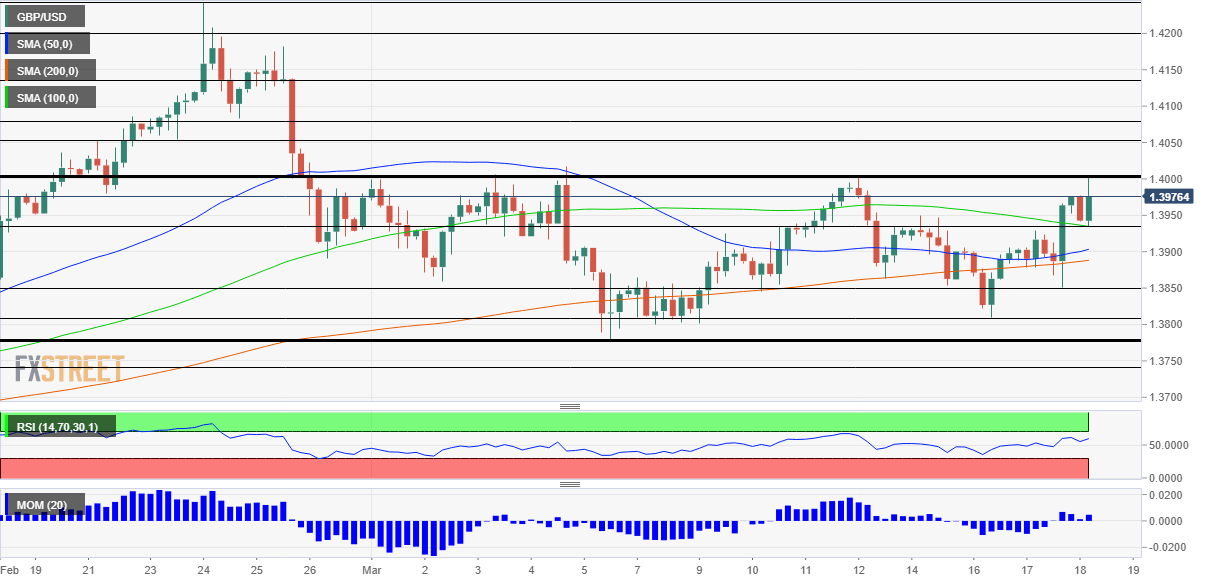

- Thursday’s four-hour chart is painting a bullish picture.

What a difference a day makes – investors have changed their reaction to the Federal Reserve’s dovish decision and are now pushing Treasury yields and the dollar higher. Will sterling succumb to pressure?

The world’s most powerful central bank surprised by signaling it would only raise interest rates in 2024. Moreover, the Fed’s reactions are now “outcome-based” rather than trying to stay ahead of the curve. The Washington-based institution would begin talking about the tapering of bond buys or rate hikes only after the economy significantly bounces back. Prospects of lower borrowing rates for longer are music to markets’ ears – stocks advanced and the dollar dropped.

- Powell and the FOMC: Is it really about the Fed Funds Rate?

- Fed Analysis: Dovish dots down dollar, why this may be a buy opportunity

However, that was Wednesday, and the mood has changed on Thursday. The narrative has shifted to Federal Reserve Chair Jerome Powell’s optimism – acknowledging stronger growth and a drop in unemployment. If the economy bounces rapidly, perhaps the Fed would raise rates earlier. The US ten-year Treasury yield has shot up to 1.73% in a rapid move that has alarmed traders and sent the dollar back up.

What’s next? In the US, further reactions to the Fed and the movement in yields are set to impact the greenback – with weekly jobless claims serving as a temporary sideshow. A small drop in employment applications is on the cards.

See Initial Jobless Claims Preview: Improvement is relative

Upbeat BOE?

In the UK, it is all about the Bank of England – and about yields. The Reserve Bank of Australia intervened to lower returns on domestic bonds, and the European Central Bank will ramp up its debt purchases from April. On the other side of the ring, the Fed is only worried about the pace but not about the increase in yields.

Where is the “Old Lady” as the BOE is also known? Probably on the side of the Fed, seeing rising returns on UK Gilts as a sign of better growth prospects. The UK vaccination campaign has already reached more than one in three Brits and coronavirus cases are falling at a satisfactory rate.

The bank does not hold a press conference and will likely remain silent on yields – and staying mum means allowing them to rise. Such an increase in yields would allow the pound to recover – even if the dollar storm continues.

Bank of England Preview: Green light to gains? Three ways the BOE can boost the pound

GBP/USD Technical Analysis

Pound/dollar has been holding above the 100 Simple Moving Average on the four-hour chart despite the recent decline. Momentum is also to the upside, but only just.

For bulls to rage, GBP/USD needs to convincingly surpass the psychological barrier of 1.40 – which has capped the pair twice in the past week. Further above, 1.4050, 1.4075 and 1.4140 are eyed.

Support awaits at the daily low of 1.3935, followed by 1.3850 and 1.3810.