- EUR/USD has been reversing its gains as US yields jump higher in a Fed rethink.

- US jobless claims and the EU’s vaccine issues are also eyed.

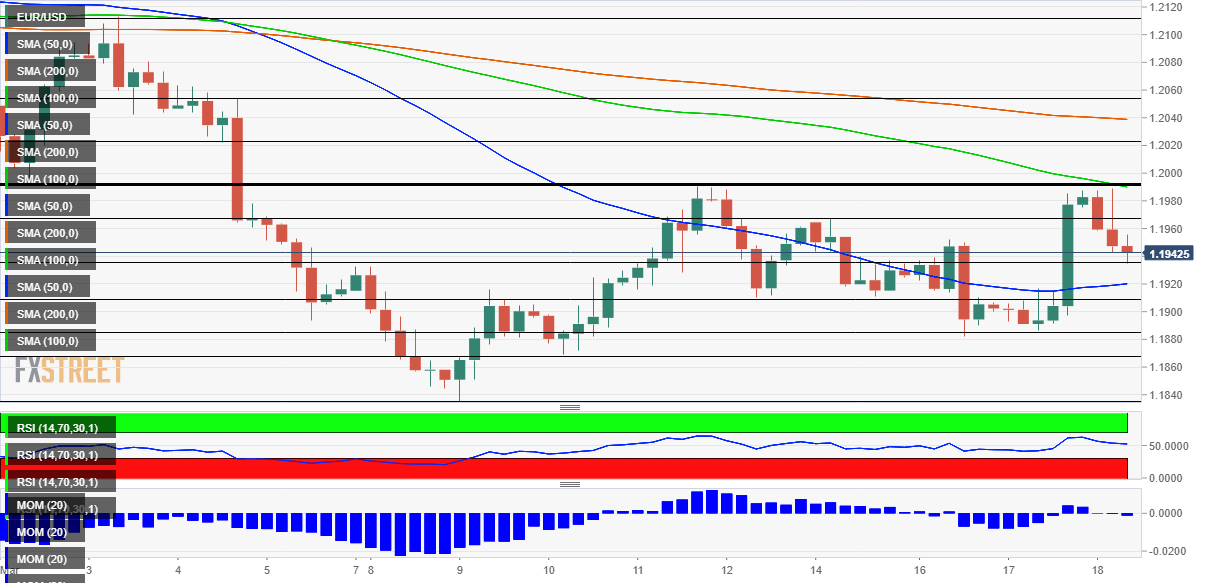

- Thursday’s four-hour chart is pointing to further losses.

All yield to the US dollar – the greenback is gaining new ground as the dust settles from the Federal Reserve’s dovish decision. For the vulnerable euro, there is only one direction – down.

The Fed’s “dot-plot” surprised markets on Wednesday with a rate hike projected only for 2024. Moreover, Chair Jerome Powell stressed that any signals on tapering down the pace of bond buys – let alone rate hikes – will come only after economic improvement materializes. His “I’ll believe when I see it” approach contrasts the bank’s historic stance of trying to stay ahead of the curve and preempting future inflation.

- Powell and the FOMC: Is it really about the Fed Funds Rate?

- Fed Analysis: Dovish dots down dollar, why this may be a buy opportunity

The initial reaction of lower yields and a weaker dollar has faded on Thursday. Investors are focusing on more upbeat aspects of the Fed decision – upgraded growth and employment projections. Moreover, markets have had second thoughts also on Powell’s repeated statement that the inflation in the spring is transitory. The rapid sell-off in bonds – with the ten-year Treasury yields hitting 1.744% – has jolted the dollar higher.

Will the greenback continue gaining ground? That partially depends on weekly jobless claims, which are set to post a marginal decline. However, further responses to the Fed and yields have the upper hand.

See Initial Jobless Claims Preview: Improvement is relative

In the bigger scheme of things, the dollar is rising amid a strong economy, benefiting from an injection of $1.9 trillion in stimulus funds and also a rapid vaccination campaign.

That contrasts with ongoing immunization issues in the old continent. EU Commission President Ursula von der Leyen has threatened to ban exports of vaccines made in Europe to the UK, as the row intensifies. In the meantime, most European countries have suspended the administration of AstraZeneca’s jabs amid concerns about safety.

Even if the European Medicines Agency gives the green light to resume the usage of Astra’s doses, many Europeans are set to refuse to receive them. Overall, the eurozone is set to lag behind in its recovery from the crisis – and that may weigh on the euro.

Overall, EUR/USD is set to remain under pressure.

EUR/USD Technical Analysis

Euro/dollar has been rejected at 1.1990 – the same cap it hit late last week. That double-top also converges with the 100 Simple Moving Average on the four-hour chart. Momentum has flipped back to the downside and the pair also trades below the 200 SMA. Bulls may find solace in the pair’s trade above the 50 SMA.

Support awaits at the daily low of 1.1935, followed by 1.1910, which was a cushion earlier in the week. Further down, 1.1885 and 1.1836 are eyed.

Resistance is at 1.1965, a cap from last week, and then the 1.1990 mentioned earlier. Further above, 1.2020 and 1.2055 await EUR/USD.