- GBP/USD has been retreating from the highs as US yields resume their gains.

- Britain’s upbeat data and vaccine situation may help it weather the storm.

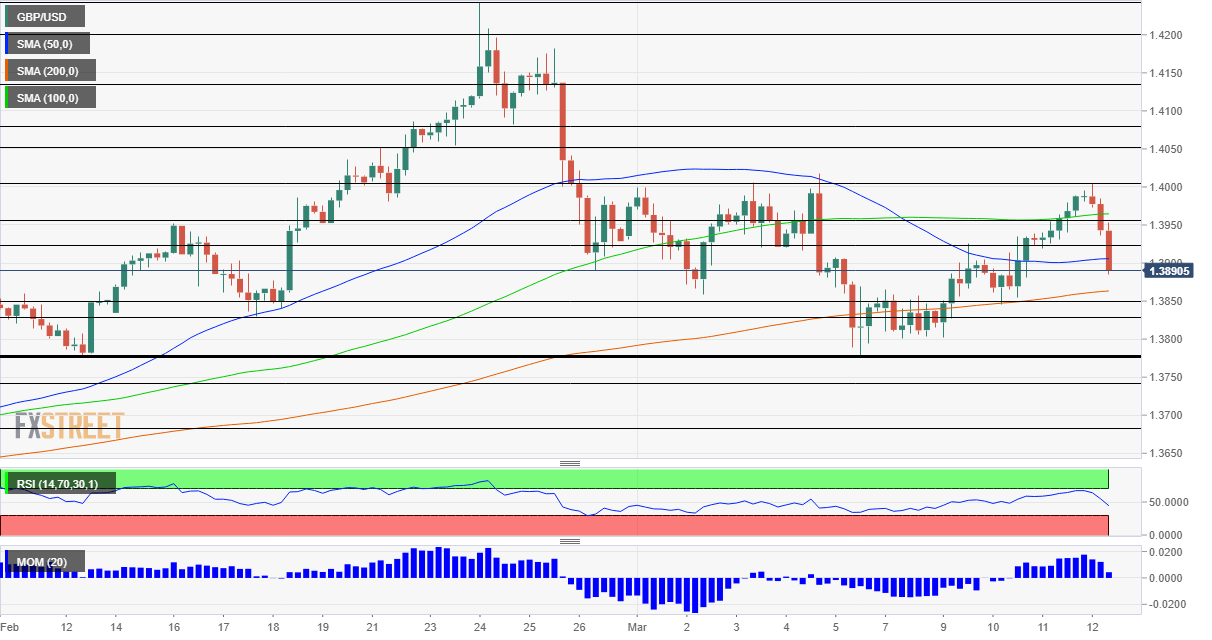

- Friday’s four-hour chart is painting a mixed picture.

Is the US going to surpass the UK in vaccinations? Britain is undoubtedly in the lead but President Joe Biden’s America is undoubtedly accelerating – and that is one of the reasons boosting the dollar.

The Commander-in-Chief signed the coronavirus relief bill into law and raised expectations by setting a target that every American could get a COVID’-19 vaccine from early May. The US has reached nearly 20% of its population while the UK is already roughly at 35% – but Britain has barely inoculated people with the second dose.

Apart from ramping up its vaccination campaign, upbeat data is also boosting the greenback. Jobless claims beat estimates with a fall to 712,000 in the week ending March 5, and the University of Michigan’s Consumer Sentiment Index is forecast to show a minor increase in confidence.

See US Michigan Consumer Sentiment March Preview: The post-COVID blues

Nevertheless, the UK’s immunization campaign is still impressive and local data beat expectations as well. Gross Domestic Product dropped by 2.9% in January – better than expected in a month of strict lockdown.

Can sterling hold up against the dollar? The pound has shown strength, but the main driver remains US bond yields. Returns on ten-year Treasuries edged up to 1.60%, a level seen as critical to dollar strength while a drop under 1.50% tended to push the greenback lower.

All in all, GBP/USD is holding up better than other pairs, but another surge in yields could push the pair lower.

GBP/USD Technical Analysis

Pound/dollar has slipped below the 50 and 100 Simple Moving Averages on the four-hour chart, but momentum remains to the upside. While the pair holds above the 200 SMA, bulls still look strong.

Support awaits at 1.3850, a support line from mid-March, and the 1.3830, a cushion from mid-February. The critical line to watch is 1.3775, March’s trough.

Some resistance awaits at 1.3925, which was a temporary peak, followed by 1.3950, which is where the 100 SMA hits the price. It is followed by the psychological barrier of 1.40.