- EUR/USD has been recovering amid temporary market calm.

- Expected strong US figures, stimulus progress and America’s vaccine ramp-up set to boost the greenback.

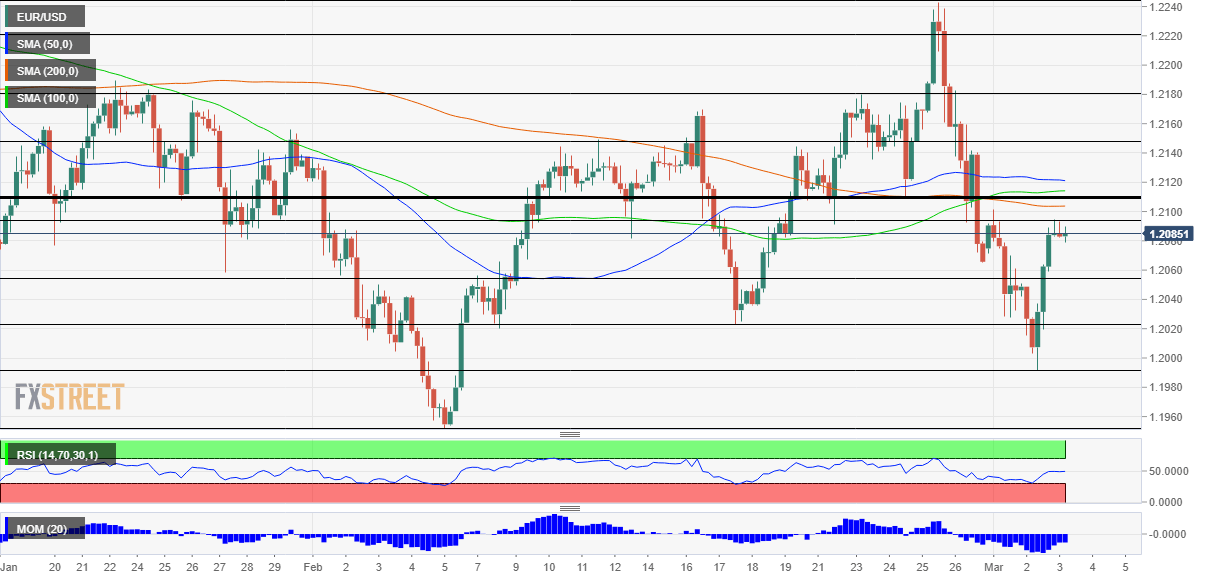

- Wednesday’s four-hour chart is showing that the currency pair faces tough resistance.

One step up, now two steps down? The relative calm has allowed the euro to lick its wounds and edge higher – but King Dollar is now set for a comeback, fueled by data and other factors.

US ten-year bond yields have stabilized around 1.40% after several days of turbulence that caught the eye of Federal Reserve Governor Lael Brainard. The world’s most powerful central bank sees the increase in returns on US debt as a positive sign, it is just worried about volatility. Yet even without eye-catching moves, higher yields continue supporting the dollar.

Chicago Fed President Charles Evans speaks on Wednesday, and unless he offers action such as buying bonds, the dollar will likely remain bid. And there are good reasons. That contrasts the European Central Bank’s alarm about higher bond yields.

Economists expect the ISM Services Purchasing Managers’ Index to print 58.7 points in February – prolonged growth in America’s largest sector. The Manufacturing PMI smashed estimates earlier in the week with 60.8.

Ahead of ISM’s release, ADP’s employment figures are forecast to show an increase of 177,000 private-sector jobs. While the correlation between the payroll firm’s statistics and official data has been sketchy in the coronavirus era, the publication moves markets.

See:

- US ADP Employment Change February Preview: How soon will the small business sector bounce?

- US ISM Services PMI February Preview: Expect more than expected

EUR/USD may also reflect the gap in vaccination campaigns. While the old continent is struggling to get people to take the AstraZeneca jab, the US is ramping up the rollout and also production. Merck agreed to produce Johnson and Johnson’s single-shot inoculations and President Joe Biden stated that every American could be offered a vaccine by the end of May.

Also in Washington, the Senate will begin debating Biden’s $1.9 trillion covid relief package on Wednesday. While the president urged lawmakers to leave as much as possible unchanged, some elements such as the minimum wage hike will likely fall out of the legislation passed by the House. Nevertheless, advancing stimulus will likely add propping up the greenback.

On the other side of the pond, Germany is set to formally extend lockdown measures until the run-up to Easter, while Italy’s Prime Minister Mario Draghi will reportedly slap new restrictions until after the early April holiday.

All in all, an upbeat market mood seems insufficient to push EUR/USD higher, with the dollar’s advantage likely to show up in the price shortly.

EUR/USD Technical Analysis

Euro/dollar continues suffering from downside momentum on the four-hour chart and trades below the 50, 100 and 200 Simple Moving Averages – which are all converging around the 1.2110 level. That critical confluence is a make or break point for the pair.

Looking down,. support awaits at 1.2055, which separated ranges lately and also was a swing low in January. It is followed by 1.2020 and 1.1990.

Above 1.2110, the next line to watch is 1.2150, which held EUR/USD in mid-February, followed by 1.2180 1.2220.

Where next for the dollar as the Fed refocuses, bonds bring action, jobs set to cause jitters