- EUR/USD has failed to take advantage of Fed Chair Powell’s dovish words.

- A delay in vaccine deliveries to Europe and an extended German lockdown may weigh on the euro.

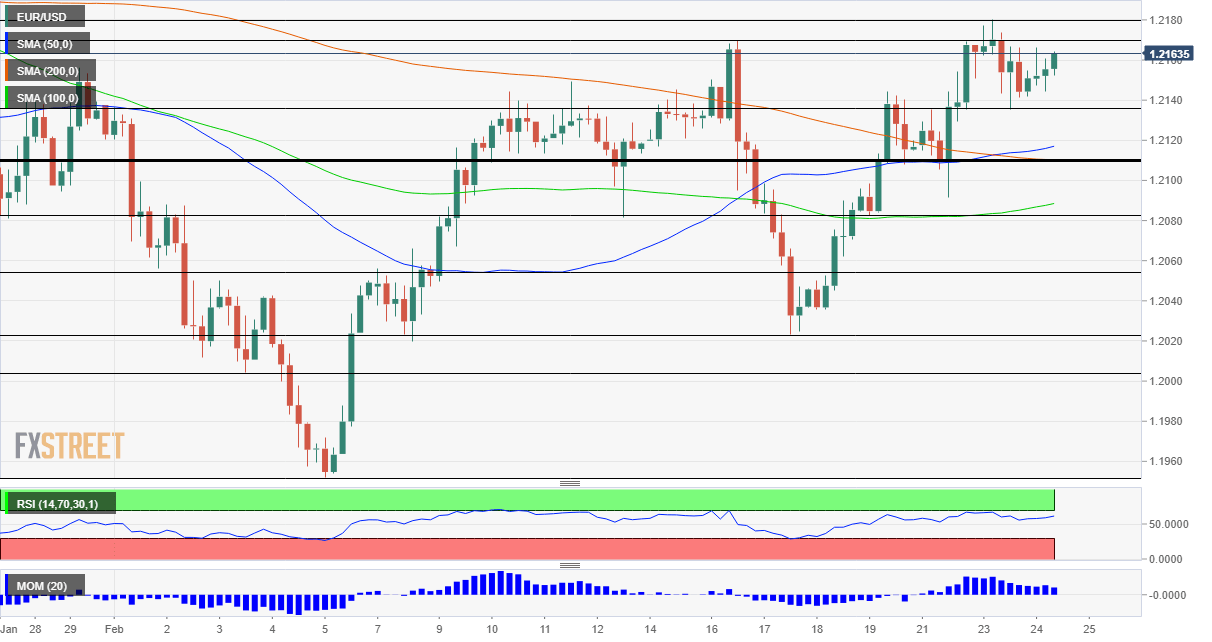

- Wednesday’s four-hour chart is showing bulls are losing momentum.

Hear no evil, see no evil – that seems to have been the message on inflation from the world’s most powerful central banker. Jerome Powell, Chairman of the Federal Reserve, soothed market concerns of early tightening and triggered a relief rally in stocks. He also sent the dollar down.

However, the euro has failed to take advantage of the dollar’s decline – exposing its weakness and hitting at falls for EUR/USD.

Powell could not have been more dovish. He said that any uptick in prices in the coming months is unlikely to be large or persistent and also dismissed fears that fiscal largesse would prompt inflation. On the other Fed mandate, full employment, the Chair stressed that ten million Americans are still out of work – disregarding the falling jobless rate.

His message to markets was loud and clear – the Fed is there to keep rates low and printing money as much as needed. At least for the greenback, creating funds out of thin air means devaluation and the dollar indeed retreated across the board.

See Dollar tumbles as Powell says no rate hike, no taper

That decline was evident in commodity currencies and the pound, but the common currency’s performance has been mediocre at best. Why did the euro fail to rally?

Europe has been lagging behind in its vaccination efforts and another blow has come from AstraZeneca. The British-Swedish firm told the EU that it will deliver only 90 million doses in the second quarter – half the original estimate. AstraZeneca’s announcement is the second such delay from the firm and joins similar postponements from Pfizer and Moderna.

The old continent immunization gap has significant economic implications. Germany is mulling an exit strategy from current restrictions and that will likely be delayed. Both Europe’s locomotive and other France are also struggling with the distribution of jabs.

One positive development has come from a minor upgrade in Germany’s fourth-quarter Gross Domestic Product growth from 0.1% to 0.3%. However, markets are focused on the spring rather than the winter.

Looking forward, Powell appears before a different committee on Wednesday and will likely repeat these same dovish messages. His colleagues Lael Brainard and Richard Clarida will also speak and they are all set to calm markets. US New Home Sales are set to show upbeat activity in the housing sector.

All in all, while the Fed is putting pressure on the dollar, the euro fails to gain – and any change in mood may send the vulnerable common currency lower.

EUR/USD Technical Analysis

Euro/dollar continues benefiting from upside momentum on the four-hour chart but that has somewhat weakened. Bulls may find comfort in the pair’s trade above the 50, 100 and 200 Simple Moving Averages.

Support awaits at the daily low of 1.2140, followed by critical support at 1.2110. That is where the 200 SMA hits the price and nearly converges with the 50 SMA. Further down, 1.2080 and 1.2055 are eyed.

Some resistance is at 1.2166, the daily high, and then at 1.2180, the weekly high. Further above, the upside target is 1.2220.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750