- GBP/USD has been retreating from the highs as higher US yields boost the dollar.

- The UK’s progress on the coronavirus front gives sterling an edge.

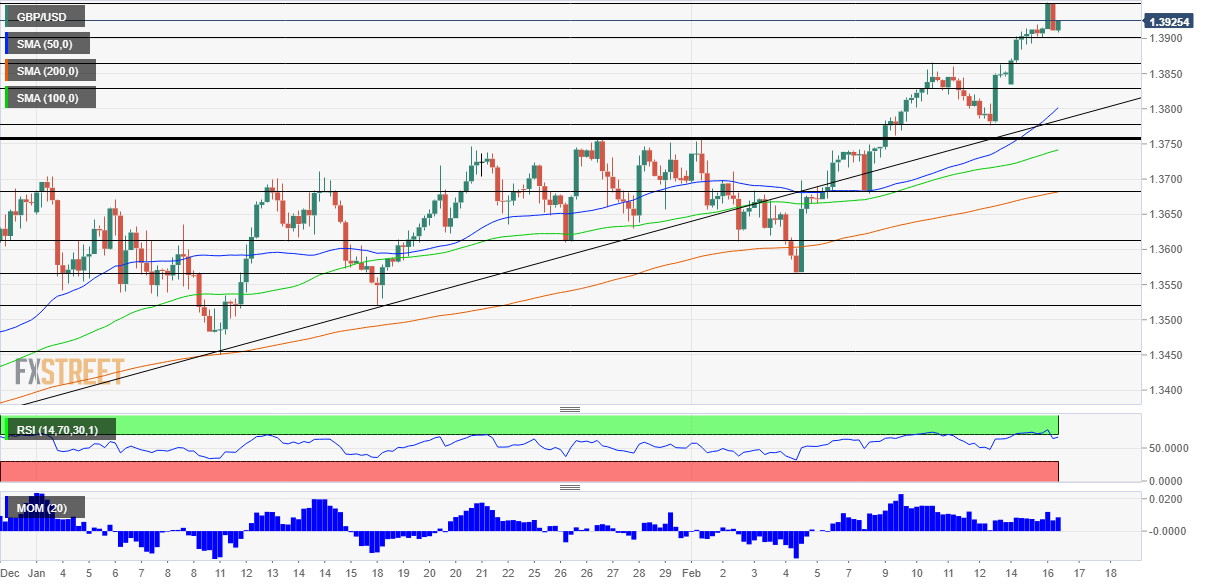

- Tuesday’s four-hour chart is showing that the currency pair is outside overbought conditions.

One step back before the next two steps forward? A quick look at the GBP/USD chart is pointing to a positive pattern for the pound – and Britain’s success in curbing coronavirus is the major fundamental reason to think bulls will prevail.

Why is the dollar rising? The greenback is benefiting from higher US yields, in a correlation already seen several times in 2021. US President Joe Biden returns to work after a long weekend and his $1.9 trillion covid relief package is left, right, and center.

What will be the final bill? Investors are aware that compromises will likely push the cope lower, but are happy with the potential progress – the Senate concluded the trial of his predecessor Donald Trump on Saturday, clearing the agenda for stimulus.

The upcoming fiscal boost from America is music to markets’ collective ears and previously pushed the safe-haven dollar lower. On the other hand, the prospects of faster growth and higher debt issuance have now resulted in a sell-off of US bonds, pushing yields higher and thus making the greenback more attractive.

While this tug of war between the diminishing need for safety and higher returns on Treasuries occupies the dollar, sterling has its reasons to rise. The UK recorded the lowest number of COVID-19 infections since October, the result of the nationwide lockdown and the vaccination campaign. The immunization effort continues at full speed, with Britain already jabbing nearly 24 doses per 100 persons.

![]()

Source: FT

Prime Minister Boris Johnson is planning a major speech on Monday, to lay out his plans to ease the lockdown. Details are set to begin leaking and any rapid reopening may boost the pound. All in all, cable has room to rise.

GBP/USD Technical Analysis

Pound/dollar continues benefitting from upside momentum on the four-hour chart while the Relative Strength Index is just below 70 – outside overbought conditions. Moreover, the currency pair is trading above the 50, 100 and 200 Simple Moving Averages.

Bulls remain in control.

Resistance awaits at 1.3950, the new 2021 top and the highest since April 2018. Further above, 1.40, 1.4110 and 1.4240 are the next levels to watch.

GBP/USD has some support at around 1.39, followed by 1.3865, the previous peak. Further down, 1.3830 and 1.3870 are the next cushions.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits