- EUR/USD has been advancing as the dollar retreats alongside yields.

- The trial of former President Trump may divert attention away from stimulus speculation.

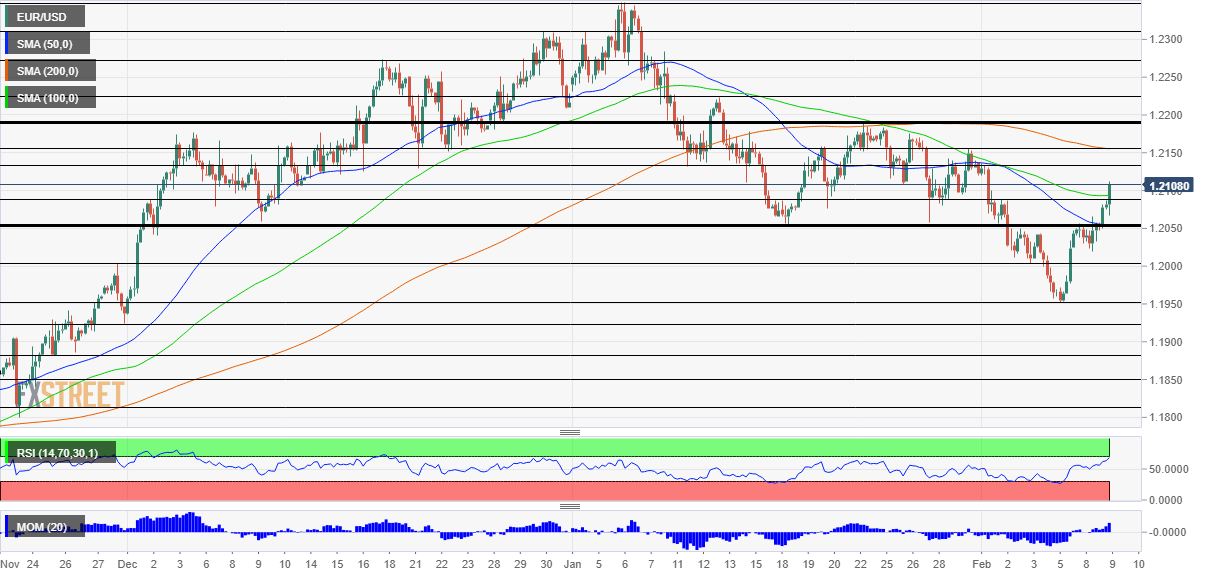

- Tuesday’s four-hour chart is showing an improving picture

Distraction can be a good thing – at least for the euro. Markets are awash with cash, and as funds have flown into bonds once again – without leaving stocks – the drop in US yields has been weighing on the dollar. In parallel, records highs in stocks – and also Bitcoin, another distraction – have been weighing on the safe-haven dollar. The change in narrative has propelled EUR/USD to 1.21.

Can this uptrend continue? One of the main market movers has been speculation about the size of the relief package that Democrats are able to pass. President Joe Biden is urging Congress to approve his original plan worth $1.9 trillion but is also willing to compromise – mostly with members of his party, rather than Republicans.

Moderates and liberals are at odds over eligibility for stimulus checks. Centrists prefer an income limit of $50,000 per year and the left-wing wants it to rise to $75,000. Investors seem disinterested in these details and simply want a quick and smooth approval in Congress, regardless of which side wins and what the GOP thinks.

The political focus is set to shift from stimulus to the start of former President Donald Trump’s impeachment trial for inciting the insurrection on Capitol Hill in early January. Trump’s future is of no interest to markets, but the distraction may delay stimulus in turn. In turn, investors may continue buying bonds in anticipation that the relief package would be delayed and eventually be smaller. A drop in yields would be adverse for the dollar.

For the euro, Trump’s trial is a welcome distraction from the old continent’s own woes, namely its frustratingly slow vaccination campaign. Europe’s meager immunization effort is already weighing on sentiment, as seen in the Ssentix Investor Confidence for February which dropped to -2 points, reflecting pessimism.

Will markets turn against the euro? The broader EUR/USD downtrend is intact, but Tuesday’s trading will likely see an extended upswing. Dollar weakness, stemming from postponing stimulus, may drive returns on US debt lower, carrying the dollar with it.

EUR/USD Technical Analysis

Euro/dollar has jumped above the 1.2050 level – a clear separator of ranges – and has broken above the 50 and 100 Simple Moving Averages on the four-hour chart, a bullish sign. Alongside upside momentum, there seems to be more room for gains.

Resistance awaits at 1.2130, which provided support in early January. It is followed by 1.2150, where the 200 SMA hits the price. Further above, 1.2190 was a double-top and is a significant cap.

Some support awaits at 1.2090, where the 100 SMA hits the price, followed by 1.2050 mentioned earlier. Further down, 1.20 and 1.1950 await EUR/USD.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750