- GBP/USD has been extending its gains after the BOE signaled no negative rates.

- US Nonfarm Payrolls carry high expectations and may trigger a dollar downfall.

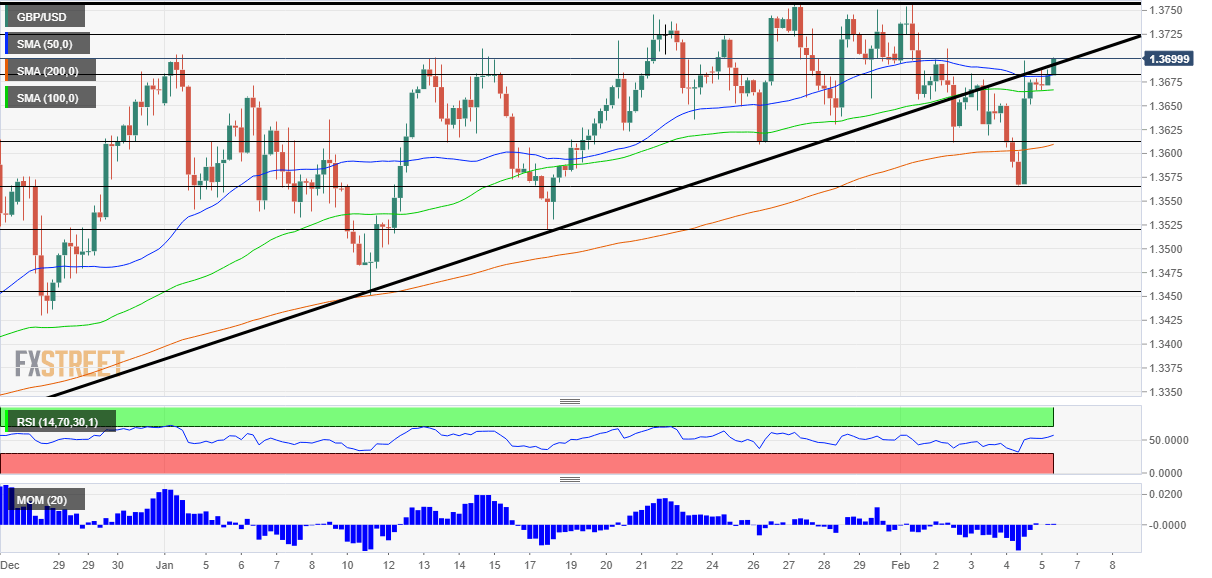

- Friday’s four-hour chart is showing cable has recaptured the uptrend support line.

Prime Minister Boris Johnson may be a “comeback kid” – returning to the government and at the top job – and the pound is making similar moves. After having returned to 1.37, the cable needs a minor miss on US Nonfarm Payrolls to attack the 2021 high of 1.3752.

Sterling shot higher on Thursday in response to the Bank of England’s announcement that negative interest rates are off the agenda. While the BOE continues examining the technicalities of such a move, Governor Andrew Bailey stressed it is not imminent. Moreover, the “Old Lady” as the bank is known, seemed upbeat after the economy handled the recent lockdowns well and as Britain’s vaccination campaign is moving at a rapid clip.

The pound was able to defy dollar strength – related to upbeat jobless claims and hopes for a large stimulus package. US figures have been robust throughout the week, raising expectations for Friday’s Nonfarm Payrolls report and boosting the greenback. Are “whisper numbers” too high?

While the economic calendar is pointing to an increase of 50,000 jobs, investors are eyeing higher levels and that may trigger a “buy the rumor, sell the fact” response weighing on the dollar. That could send GBP/USD to new highs.

See

- Nonfarm Payrolls Preview: Dollar needs a strong number to keep rallying

- Nonfarm Payrolls January Preview: Waiting for the dollar bid

After the NFP, markets may return to the following developments related to President Joe Biden’s relief package. While the White House continues talking with moderates, Democrats are advancing legislation to approve a stimulus package on their own – potentially a larger one. Higher prospects of a generous package may send investors away from bonds, raising yields, and supporting the dollar. However, that may come over the weekend.

All in all, GBP/USD has room to extend its gains unless a large stimulus package is approved in Washington.

GBP/USD Technical Analysis

Pound/dollar has recaptured the broken uptrend support line that accompanied it since late 2020 and also surpassed the 50 Simple Moving Average on the four-hour chart. Moreover, momentum has flipped back to the upside.

Resistance awaits at 1.3725, a high point in January, followed by 1.3752, the 2021 peak. The next levels to watch are 1.3810 and 1.40, dating back to 2018.

Support awaits at 1.3680, which is where the 50 SMA hits the price. It is followed by 1.3614, a support line from early in the week, and then by 1.3565, Thursday’s low point.

More

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits