- GBP/USD has been retreating from 1.37 as the dollar benefits from covid, stimulus concerns.

- Brexit issues, fears about delaying the second dose, and Scotland’s independence push weigh on the pound.

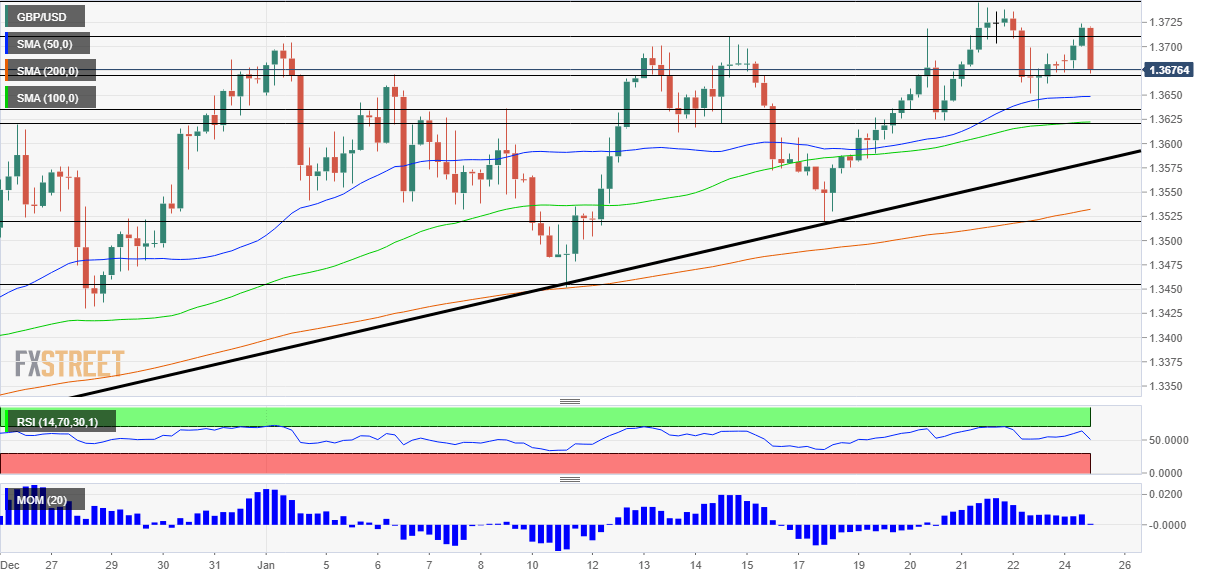

- Monday’s four-hour chart is showing bulls are losing ground.

How urgent is the second COVID-19 vaccine shot? The UK’s controversial delay of the second jab is only one issue weighing on sterling.

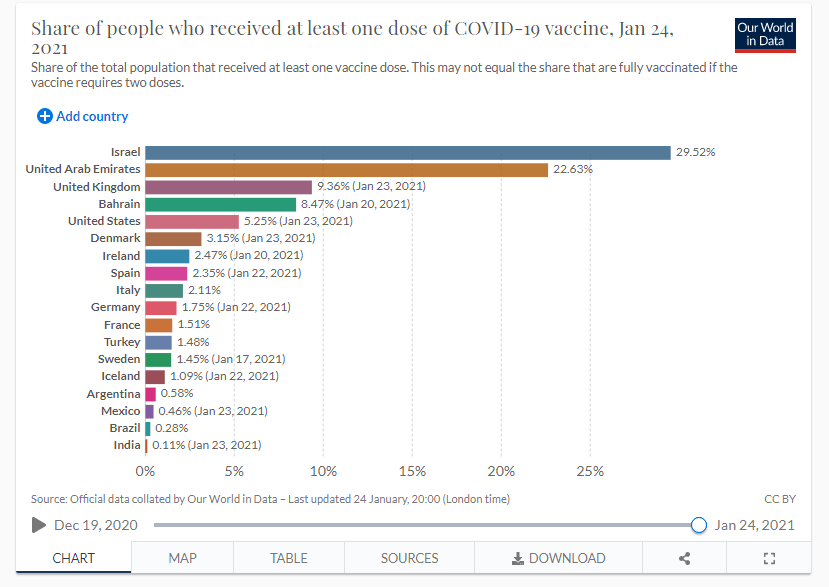

Evidence coming from Israel, the world’s leader in vaccination, suggests that a high level of defense against the disease is achieved only after the booster jab. Will reaching more people with a lower immunization level be sufficient? Time will tell, but doubts are already taking their toll on sterling.

Source: OurWorldInData

Another issue is Brexit. Investors mostly forgot about the saga after the EU and the UK reached an agreement on Christmas Eve – but the friction is becoming apparent in recent days. Officials at the Department for International Trade advised exporters to set up shop in Europe to avoid border issues. Opening separate companies in the bloc would allow them to circumvent paperwork and taxes resulting from the exit.

The third weight on the pound comes from the north – Scotland is pushing for another independence referendum. Support for a poll and for leaving have risen with Brexit and they cause another headache for Prime Minister Boris Johnson.

All these gloomy headlines – coming one week after Blue Monday – all add to fresh gains for the dollar. The greenback is catching a bid amid concerns about the new variants of coronavirus and also uncertainty about President Joe Biden’s stimulus plan.

While the British covid strain succumbs to vaccines, there are signs that it is more lethal than the normal type of the virus. Concerns about the South African and Brasilian versions are greater – with some fearing they are resistant to the jabs.

Moderate Republicans and Democrats pushed back against Biden’s large $1.9 trillion stimulus plan. The administration may opt to pass only disease-related expenditure, which is less controversial or opt for Dems to go big, albeit without GOP support. So far, the new president is moving fast and new headlines from Washington are set to move markets. Biden speaks about American manufacturing later in the day.

While the UK’s vaccination campaign is running at high speed, various British worries and US stimulus uncertainty may weigh on the cable.

GBP/USD Technical Analysis

Momentum on the four-hour chart is all but gone – sowing that bears are gaining ground. On the other hand, pound/dollar continues holding above the 50, 100 and 200 Simple Moving Averages. The battle continues.

Some support awaits at the daily low of 1.3665, followed by 1.3630 and 1.3615, both stepping stones on teh way up. The next noteworthy cushion is only at 1.3620.

Resistance is at 1.3705, the initial 2021 peak, followed by 1.3745, the new peak. The next lines to watch are 1.3830 and 1.40.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits