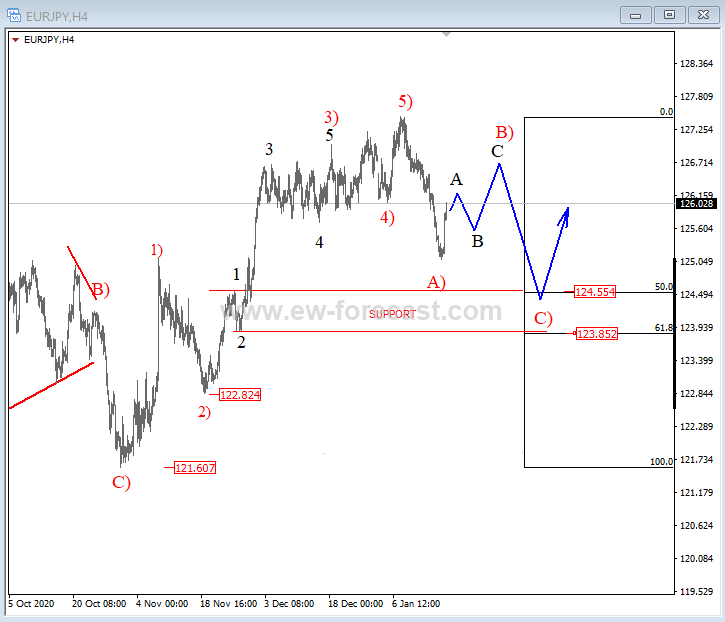

–After a completed bullish five-wave cycle, EURJPY can be making an (A)-(B)-(C) correction before the uptrend resumes–.

Hello traders!

Today we will talk about EURJPY, its price action from technical point of view and wave structure from Elliott Wave perspective. If you are familiar with EW, then you know that after every five waves, a three-wave corrective setback follows before we may see a trend continuation, in this case bullish one. And as you can see on the 4h chart below, EURJPY made nice and clean five-wave recovery from 121.60 lows which actually confirms a bullish trend. Well, after recent sharp and strong decline, it seems like it’s trading now in an (A)-(B)-(C) correction that can send the price back to 124.55 – 123.85 support zone from where we can expect aanother resumption of an uptrend.

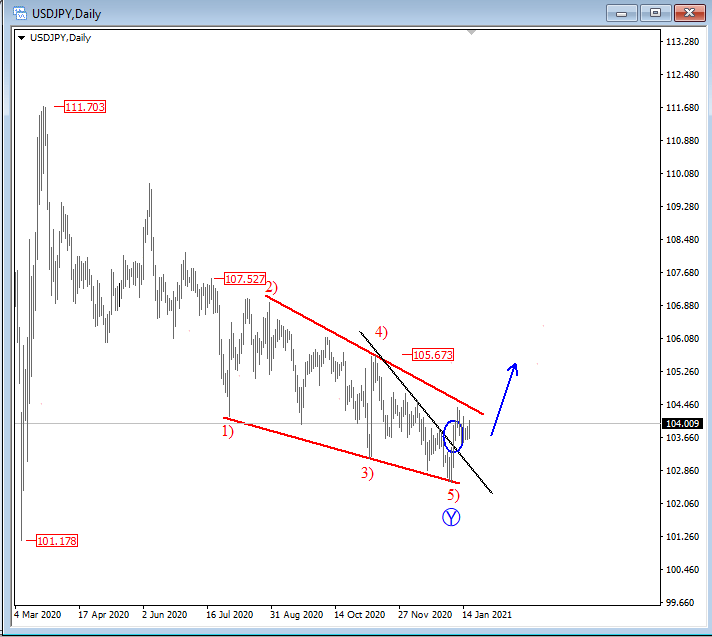

The main reason for JPY weakness in the upcoming weeks can be also USDJPY chart where price is trying to break out of a bigger daily wedge pattern that can be indicating the bottom and a bullish reversal in progress.

Trade well!

EURJPY,4H

USDJPY, Daily