- GBP/USD has recovered from the abyss as markets calm about the virus strain.

- A Brexit breakthrough on fisheries could be around the corner.

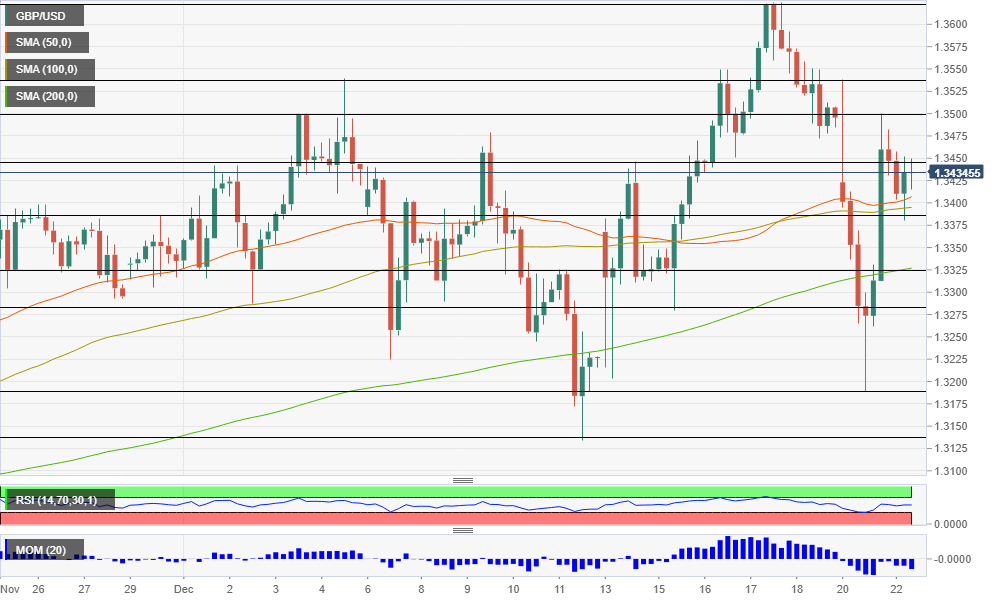

- Tuesday’s four-hour chart is showing an advantage for the bulls.

Is sterling set to throw off the shackles like the Incredible Hulk and roar higher? UK Prime Minister Boris Johnson once compared himself to the green giant when referring to Brexit talks with the EU back in 2019. He may now allow for a rally by making a concession to Brussels.

The PM reportedly tabled an offer that reduces the catch that the bloc’s boats fish to 35% from 60% originally demanded. Brussels still wants 25%, but even without getting into the details of the minuscule industry, nearly halving a demand.

Lobbyists in the European fishing industry have pressured Chief EU NEgotiator Michel Barnier to hold his ground, but will a small concession on 0.1-0.2% of economic output prevent a deal? The other topics such as the Level-Playing Field have roughly been resolved.

Overall, there is significant room for optimism on the Brexit front. What about the new covid strain? The panic about a situation “out of control” has led to bans on flights to and from the UK – and a partial French closure of the border, causing lengthy traffic jams.

On this front, Johnson’s approach has been calm, promising to work with his French counterparts to resolve the issue. Indeed, early on Tuesday reports came out about a potential solution to the passage of goods across the English Channel.

While the mutation is highly transmissible, there is no evidence that it is resistant to the vaccines. Moreover, it is probably circulating in the continent and elsewhere, and was detected in Britain only thanks to the country’s high genetic sequencing capacity.

All in all, the panic early on Monday is turning into calm with the potential for rises.

Sterling also benefits from an upgrade to third-quarter Gross Domestic Product figures, which came out at 16% quarterly against 15.5% projected. Final GDP figures from the US are due out later, and they will likely confirm the 33.1% annualized bounce in output.

Congress passed the $900 billion stimulus bill which had already been announced over the weekend, providing calm to markets.

GBP/USD Technical Analysis

Poun/dollar is still suffering from downside momentum on the four-hour chart but has swiftly recaptured the 50, 100 and 200 Simple Moving Averages and the Relative Strength Index has stabilized.

Some resistance awaits at 1.3540, a high point last week, followed by 1.35, Monday’s swing high. It is followed by 1.3535, another temporary peak, and then by the 2020 top of 1.3622.

Support awaits at the daily low of 1.3380, followed by 1.3325, which is where the 200 SMA hits the price. Further down, 1.3280 and 1.3185 await cable.

More Three reasons to expect a sustained Santa rally for sterling