- AUD/USD is off the lows, battling the 0.71 level.

- Upbeat Chinese data and optimism on trade help on a busy day.

- The technical picture remains bearish for the pair.

AUD/USD is off the lows of 0.7084 and battles the 0.71 handle. The independent forward-looking gauge of the Chinese economy, the Caixin Manufacturing PMI, beat expectations and hit 49.9 points, just under the 50-point threshold that separates expansion from contraction. The number even came out better than the official government PMI. The good news from Australia’s No. 1 trading partner supported the A$.

In addition, White House Economic Adviser Larry Kudlow said the US and China are close to sealing a “historic accord”, contradicting the lower expectations projected by USTR Robert Lighthizer. The market mood improved and allowed the greenback to retreat after it rose on top of the upbeat US GDP on Thursday.

The latest US data already missed expectations with Personal Spending falling by 0.5% and Personal Income by 0.1%. The Fed’s preferred measure of inflation, the Core PCE Price Index, remained unchanged at 1.9%.

There is still one more significant figure coming up: the ISM Manufacturing PMI, which rose in January after a drop in December.

See: ISM Manufacturing PMI Preview: shutdown, what shutdown

AUD/USD Technical Analysis

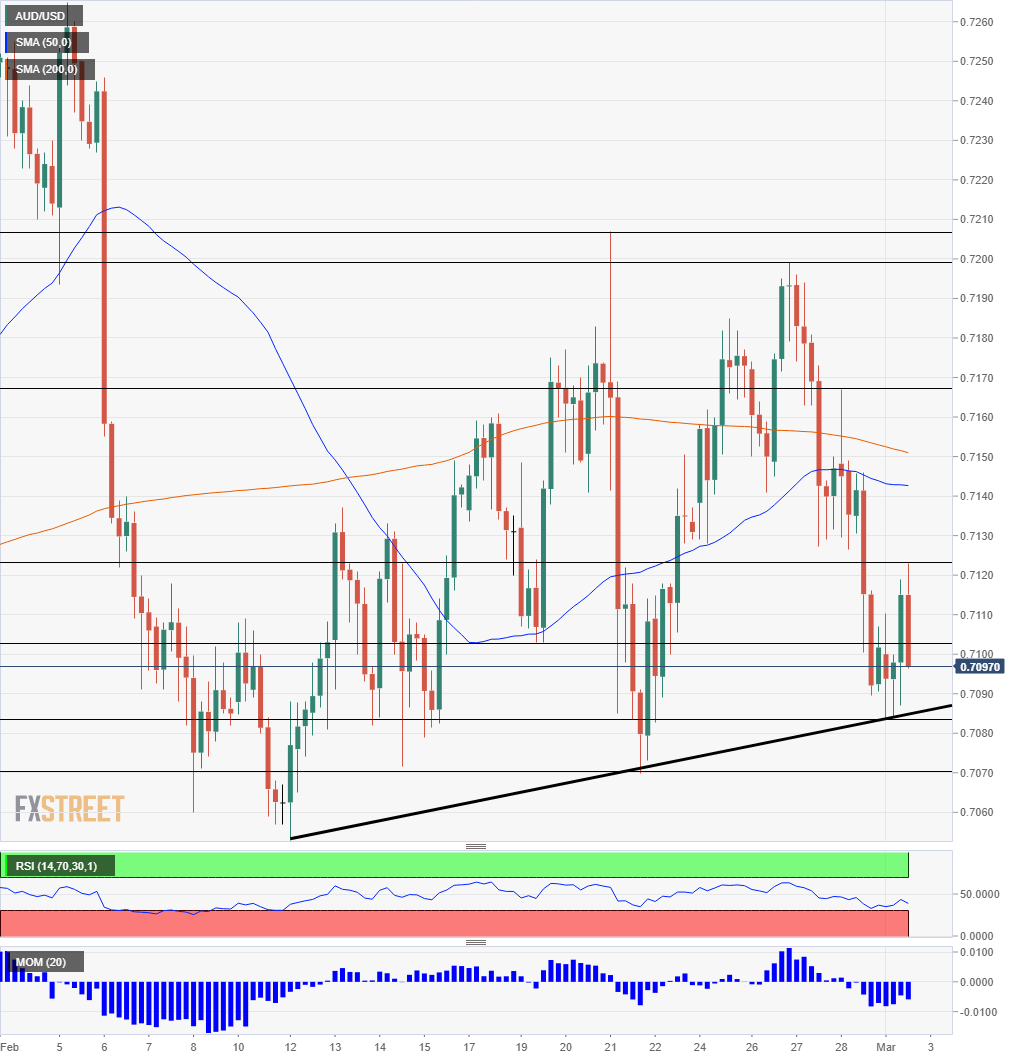

AUD/USD is still suffering from downside Momentum on the four-hour chart. In addition, it is trading below the 50 and 200 Simple Moving Averages and the Relative Strength Index (RSI) is above 30, not showing oversold conditions.

However, the bulls may still lean on the uptrend support line (thick black line on the chart), which accompanies the pair since early February.

0.7084 was the low point of the day and provides some support. 0.7070 was a swing low twice in February and 0.7055 was the trough last month.

0.7125 held the pair on Thursday and caps it now. 0.7165 was a swing high earlier in the week and the 0.7200-0.7205 region held Aussie/USD down during February.