Finance sector earnings were up +21.5% in the June quarter and the expectation is that growth in the Q3 earnings season, which JPMorgan (JPM), Wells Fargo (WFC) and Citigroup (C) kick-off with their results on Friday, October 12, will likely be even better. But none of that shows up in the group’s stock market performance, with bank stocks one of the weakest performers in the market.

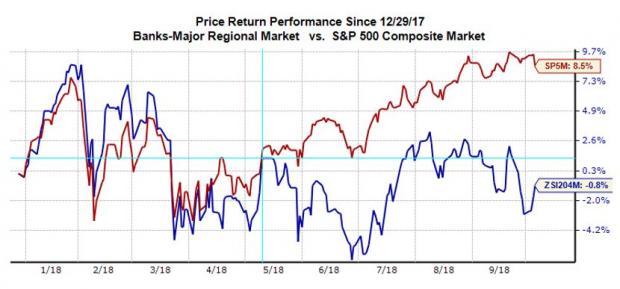

Bank stocks are down -0.8% this year, underperforming the broader market’s +8.5% gain, but modestly better than the Finance sector’s -3% decline. The group never got its mojo back after losing ground at the start of February, but continued to lead the S&P 500 through mid-March meaningfully diverging from the broader index around mid-May. The chart below shows the year-to-date performance comparison of the Zacks Major Banks industry and the S&P 500 index.

A number of factors likely account for this underperformance. The most important reason appears to be the flattening yield curve, though it has been steepening a bit in recent days. The flattening yield curve has implications for banks’ profitability, as banks’ net interest margins represent similar spread between their lending and borrowing rates.

The chart below shows the yield spread between 2 and 10-year treasury bonds over the past year (currently at 30 basis points, as of Wednesday, October 3rd).

There is also the issue of deposit betas, the percentage of change in market interest rates that banks pass onto their depositors. Banks are typically fairly stingy with interest rates on their deposits, but competitive pressures force them to pass on the higher rates to their customers. As a result, deposit betas have been steadily going up, another negative for bank margins.

Both of these are legitimate points, but worries about them appear to overdone to us. The yield spread has started expanding again. But even if this nascent steepening trend of recent days reverses, as has happened a number of times before, the spread is still most likely expected to remain positive. Similarly, even if deposit betas reach 100%, plenty of deposits are non-interest bearing. When you combine that some growth in loan portfolios and continued expense discipline, the group should have sustainable earnings growth in the high single-digits pace, beyond the current unsustainable tax-cut induced windfall.