Back in February, when the world was starting to become familiar with the trajectory of US debt and deficit spending under Trump’s fiscal plan, we showed a chart from Goldman which made a troubling forecast: the US fiscal situation was headed for “banana republic” status, or as Goldman put it more politely, “uncharted territory” as a result of soaring federal debt and interest expense.

Now, in a follow up report, Goldman economist Alec Phillips identifies the key risks that will worsen the “already-grim” US fiscal outlook (which he defines simply as “not good”). As a reminder, just yesterday we reported that the US fiscal deficit has resumed its surge, rising 40% Y/Y to $898BN for the first 11 months of the year, following the biggest monthly outlay by the US government in history.

Goldman - which now projects a $1.05tn deficit (4.9% of GDP) for FY2019 – picks up on this and writes that its expects that figure to rise significantly over time, reaching 5.5% of GDP by 2021 and 7% of GDP by 2028. This, Goldman adds ominously, “puts US fiscal policy inuncharted territory in two respects.”Â

First, running such a large primary deficit (federal revenues minus spending, not counting interest expense) in a period of strong growth and low unemployment is quite unusual, and according to Goldman is “generally reserved for times of war” as shown in the chart below.

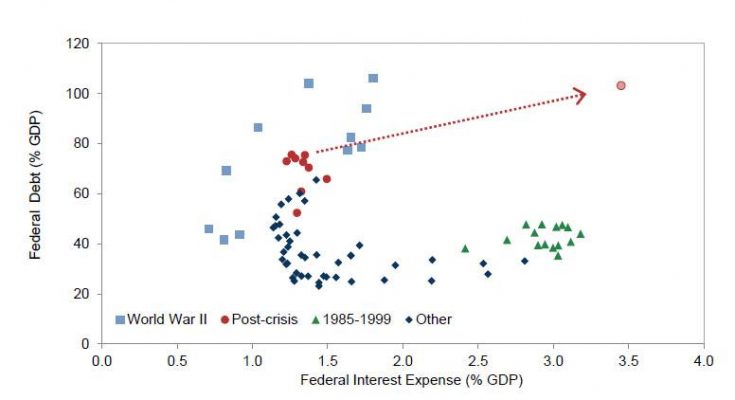

Second, the high (and rising) federal debt-to-GDP ratio “comes at a time when interest expense looks likely to rise substantially as well.” This is a similar argument to what Goldman noted back in February, and it also points out that the US also ran a very high debt-to-GDP ratio during World War II, but at the time borrowing costs were fairly low. While Goldman concedes that federal interest expense has been elevated before as well, most recently during the “bond vigilante†era ofthe 1990s, “the level of federal debt was low then and the primary deficit was relatively small. Over the next decade the US is likely to face both extremes at the same time.“