Introduction

Remember the BRICS? Brazil, Russia, India, China and South Africa? The members formed the group to be a spokesman for developing countries. But where are they now? Uncontrolled corruption in Brazil and South Africa are causing significant problems. Russia has been slowed by US sanctions. India has a high growth GDP growth rate. But as I have noted, the country faces serious problems going forward. China is the only member of the BRICS where the future looks bright.

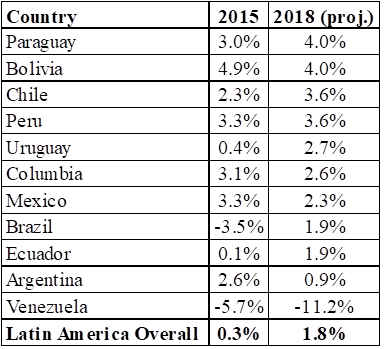

While this article focuses on Argentina, it is useful to set it in the context of Latin American progress overall. Remember how a few years back, Latin America, rich in natural resources, was seen as the next region to “take off?†As Table 1 suggests, Latin American countries turn out to be a mixed bag. And overall, they do not perform well with a projected 2018 regional growth rate of only 1.8%. While some of the smaller countries and Mexico appear to be prospering, Argentina, along with Brazil and Venezuela, are not.

Table 1. – GDP Growth Rates, Latin American Countries

Source:Â FocusEconomics

What Is Wrong in Argentina?

Argentine numbers are extreme: inflation of 30% plus with an accompanying borrowing rate in the same magnitude. In the tradition of Latin American leaders, the Kirchners talked of helping the poor while they made themselves rich by moving money from government coffers into theirs’. There are many countries with high levels of corruption that are doing well economically – China comes to mind. But past leaders of Argentina just did not care. So Macri comes to power promising a cleanup but is overwhelmed by the well-ensconced power structure and a population that accepts a fiscally irresponsible government as inevitable.

Table 2 provides the “economic vitals†on the country. Slow growth is expected to slow further in 2018 because of a severe drought reducing agricultural production. The unemployment has remained above 8% for some time. The inflation rate is expected to top 40% in the coming months. The interest rate remains extremely high, showing a lack of confidence in the government to bring it under control. The fiscal deficit is very high and the exchange rate has weakened significantly in 2018. In fact, it touched ARS 38 to the dollar last week. The trade and consequent current account balances cannot be sustained.

Table 2. Argentina: Economic Data

Source:Â FocusEconomics

The IMF Agreement

Before being elected, Macri pledged to turn the economy around. But he has not been able to do it alone. So he reached out to the International Monetary Fund (IMF) for assistance. And just recently the government entered into a standby agreement with the IMF. The government is now negotiating with the IMF to accelerate disbursements.

The highlights include:

- A three-year Stand-By Arrangement (SBA) for Argentina amounting to US$50 billion.

- US$7.5 billion, or 27% of the budget deficit will be used for budget support.

- US$35 billion will be made available over the duration of the arrangement, subject to quarterly reviews by the IMF’s Executive Board.

- The authorities’ intended policies seek to address longstanding vulnerabilities, ensure that debt remains sustainable, reduce inflation, and foster growth and job creation, while reducing poverty.

- The authorities are committed to a floating, market-determined exchange rate. They intend to limit foreign exchange intervention to periods of significant volatility and market dysfunction, and to rebuild reserve buffers.

- Given the large fiscal deficits over the past several years, the Government’s economic program is anchored on the goal of achieving federal government primary balance by 2020.