If the world’s economies still need central bank life support to survive, they aren’t healthy–they’re barely clinging to life.

The “recovery”/Bull Market is in its 10th year, and yet central banks are still tiptoeing around as if the tiniest misstep will cause the whole shebang to shatter: what are they so afraid of? The cognitive dissonance / crazy-making is off the charts:

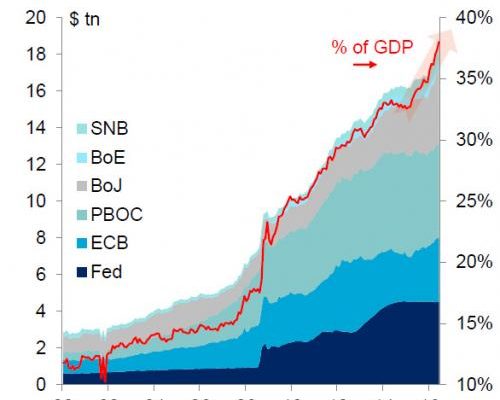

On the one hand, central banks are still pursuing unprecedented stimulus via historically low-interest rates, liquidity and easing the creation of credit on a vast scale. Some central banks continue to buy assets such as stocks and bonds to directly prop up the “market.” (If assets don’t actually trade freely, is it even a market?)

On the other hand, we’re being told the global economy is in synchronized growth and this is the greatest economy ever in the U.S. and China.

Wait a minute: so the patient has been on life-support for 10 years and authorities are telling us the patient is now super-healthy? If the patient is so healthy, then why is he still on life support after 10 years of “recovery”? If the global economy is truly healthy, then central banks should end all their stimulus programs and let the market discover the price of credit, risk, and assets.

If the economy is truly expanding organically, i.e. under its own power, then it doesn’t need the life-support of manipulated low-interest rates, trillions of dollars in central bank asset purchases, trillions of dollars in backstopping, guarantees, credit swaps, etc.

If the economy were truly recovering, wouldn’t central banks have tapered their stimulus and intervention long ago? Instead, central bank stimulus skyrocketed to new highs in 2015-2017 as global markets took a slight wobble. That little slide triggered a massive central bank response as if the patient had just suffered a cardiac arrest.

As for China’s economy being so healthy–then why are Chinese authorities expanding credit in such manic desperation? Healthy economies growing organically don’t need authorities pumping trillions of yen, yuan, euros, and dollars into credit and asset markets.