Half the sectors look solid – the other half, not so much.Â

Technology continues to be the place to trade. The thing I have to be careful of is that I don’t get overloaded in that sector because we have all seen the days where tech is selling but nothing else. So while it is great and fine to be tilted toward tech, that’s not the only sector worth trading in.Â

Below are the top 3 sectors at this stage. Depending on how the earnings go, I think there is a chance Industrials could creep in there in the coming weeks.Â

Here’s what I see as the top 3 sectors right now:

- Technology

- Healthcare

- Discretionary

The 3 worse sectors are:

- Financials

- Industrials

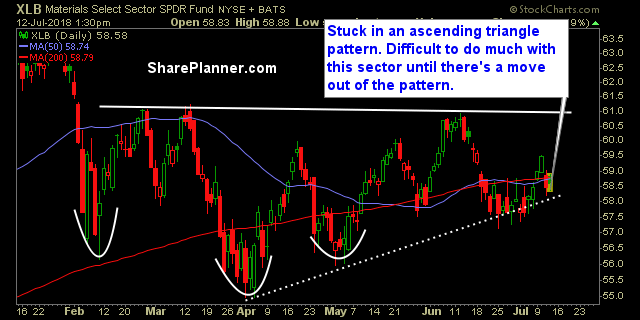

- Materials

You’ll definitely want to stay away from the financials as they start reporting tomorrow, and there’s no need for trapping yourself in a bad trade.

Let’s review the sectors:

Basic Materials (XLB)

(Click on image to enlarge)

Energy (XLE)

(Click on image to enlarge)

Financials (XLF)Â

(Click on image to enlarge)

Industrials (XLI)

(Click on image to enlarge)

Technology (XLK)

(Click on image to enlarge)

Consumer Staples (XLP)

(Click on image to enlarge)

Utilities (XLU)

(Click on image to enlarge)

Health Care (XLV)

(Click on image to enlarge)

Consumer Discretionary (XLY)

(Click on image to enlarge)