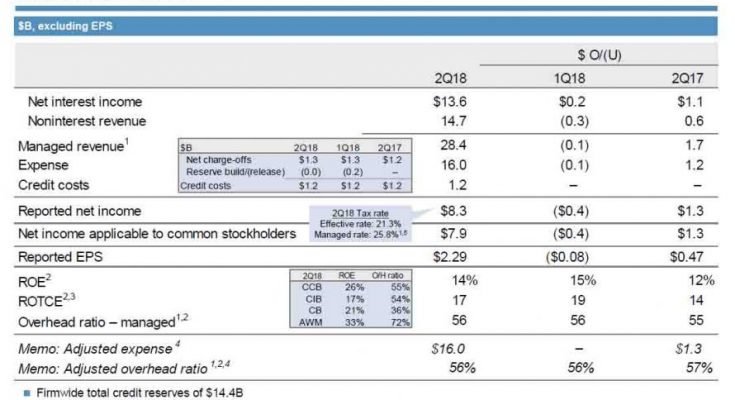

Officially launching the Q2 earnings season, moments ago JPMorgan reported strong Q2 earnings which again beat on both the top and bottom line, with adjusted revenue of $28.39BN, beating estimates of $27.34BN (and above the highest sell-side estimate of $27.84BN), generating EPS of $2.29, also beating expectations of a $2.22 print, and up 26% Y/Y.

Net income at the bank with $2.6 trillion in assets on its balance sheet rose 18% to $8.3BN, which however was a modest drop from the $8.7BN reported last quarter. At the bottom line level, JPM was quick to note that its Q2 effective tax rate was 21.3%, reflecting the lower income tax rate as Trump tax reforms.

Broken down by business segment, JPM reported revenue increases across the board:

- Consumer & community banking rose 10% to $12.5BN

- Corporate & investment bank is rose 11% to $9.9BN

- Commercial banking up 21% to $2.3BN

- Asset & wealth management down 4% to $3.5BN

Noninterest expense was $16.0 billion, up 8%, driven by higher compensation expense, investments in technology, auto lease depreciation, volume-related transaction costs, and a loss of $174 million on the liquidation of a legal entity.

Commenting on the big picture earnings, CEO Jamie Dimon said that “we see good global economic growth, particularly in the U.S., where consumer and business sentiment is high. Because of this broad growth and the strong underlying performance across each of our businesses, the company delivered record results this quarter. We also want to acknowledge that global competition is getting stronger.”

The bank also reported a provision for credit losses of $1.21BN in Q2, below the $1.48BN estimated, and virtually unchanged from the $1.215BN recorded one year ago.

At the same time, total charge-offs declined by $200 million to $1.1 billion in the quarter, thanks to a modest sequential decline in soaring credit card loans, which dipped from $1.170BN in Q1 to $1.164BN in Q2, which however was still 12% higher Y/Y from $1.037BN. JPM’s charge-off rate in cards dipped from 3.32% to 3.27%, still well above the 3.01% one year ago. According to the company, the modest deterioration in card charge-offs was more than offset by a net recovery in Home Lending driven by a loan sale.