Here is a brief review of period-over-period change in short interest in the June 16-29 period in nine S&P 500 sectors.

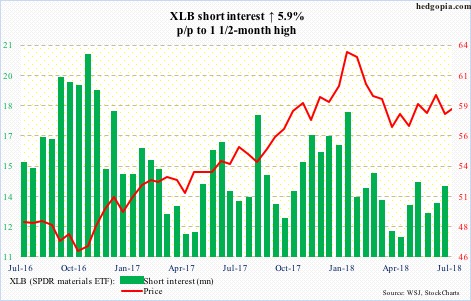

XLBÂ (SPDR materials ETF)

Â

XLB ($58.47) bulls late June defended support at $57-plus. Subsequently, the ETF pushed higher past both 50- and 200-day moving averages (merely $0.36 separate the two), but it proved fleeting. The averages have been lost. The daily chart is overbought. Odds favor the aforementioned support gets tested again.

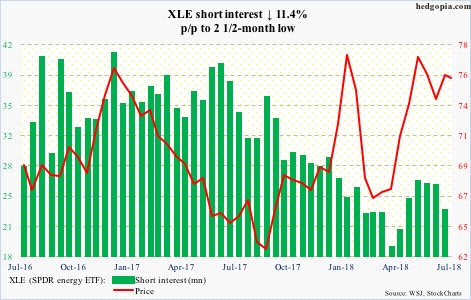

XLEÂ (SPDR energy ETF)

Â

After going sideways at the 25-26 million range for a month and a half, XLE ($75.73) short interest fell 11.4 percent during the reporting period. The ETF rallied 2.4 percent in that time. Tuesday, a daily shooting star showed up right on the upper Bollinger band. Resistance at $78-79 has proven tough to crack. The path of least resistance is down near term, with decent support at $72.50-ish.

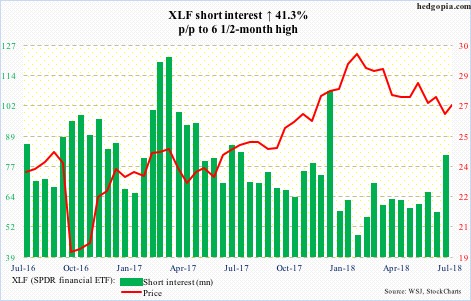

XLFÂ (SPDR financial ETF)

Â

XLF ($27.05) bears hammered on $26.50-ish for over two months – unsuccessfully. During the reporting period, they took short interest to a six-and-a-half-month high. This could come in handy for the bulls if the ETF gets an earnings tailwind. Major banks and brokers report this week and next. Big picture, XLF remains below a trend line from late-January highs, which gets tested around $27.75.

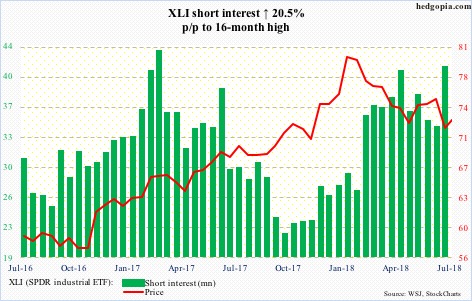

XLIÂ (SPDR industrial ETF)

Â

XLI ($72.52) short interest shot up 20.5 percent to a six-month high in the second half of June. Shorts were rewarded as the ETF fell 4.7 percent during the period. Still, support at $71-ish held firm. In the right circumstances for the bulls, the buildup in short interest the past five months can be a source of squeeze, but the ETF remains under a trend line from late January as well as both 50- and 200-day.

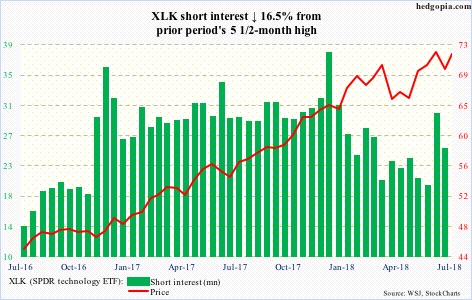

XLKÂ (SPDR technology ETF)

Â

After defending $68-69 for several sessions late June, XLK ($71.49) rallied this week to within spitting distance of its all-time high of $72.43 on June 13. The daily chart is extended. Unwinding of these conditions is the path of least resistance near term.