- Amazon will probably go up in July

- The financial sector has fallen 12 days in a row. A short term bounce is nearby.

- The Chinese stock market is getting crushed. It will probably fall a little more in the short term.

- GE’s stock spiked yesterday. This is likely a dead cat bounce. GE will probably fall within the next month.

Amazon

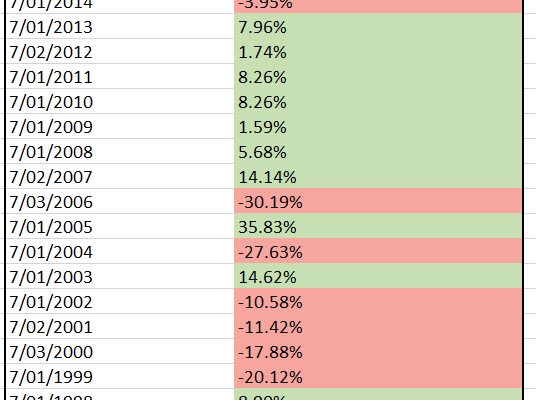

Amazon (AMZN) has had a very strong tendency to go up in July over the past 10 years. Here’s how Amazon stock performs in July (from the beginning to end of July).

Click here to download the data

Notice how Amazon’s tendency to go up in July has been especially prominent after the dot-com bust. Why?

Because July is earnings season, and Amazon tends to beat earnings expectation more often than not. When Amazon beats earnings expectations in July, its stock price is likely to pop.

Financial Sector

The S&P 500’s financial sector has fallen 12 days in a row ($XLF is the financial sector’s ETF).

This “12 days down†streak is unprecedented since 1997. With the financial sector sitting at support, we can expect a short-term bounce right now or very soon.

*This tells you nothing about the financial sector’s medium term or long term. This is only applicable for the short term.

Chinese stock market

The Chinese stock market (Shanghai Index) is getting crushed thanks to Trump’s trade war threats. The Chinese stock market has fallen A LOT more than the U.S. stock market.

The following chart demonstrates the Shanghai Index’s distance from its 200 daily moving average (we use this as a mean reversion indicator). Readings above zero indicate that the index is above its 200 dma, readings below zero demonstrate that the index is below its 200 dma.

Here’s what happens next to the Shanghai Index when it falls -13% below its 200 daily moving average for the first time in half a year.

Click here to download the data in Excel.