“Residential construction, which remained firm at the start of the year, has shown signs of slowing with the double whammy of tougher mortgage rules and rising mortgage rates, combined with fewer ready-to-build lots and permit delay.†(BMO, May Housing Starts Drop to 1 Year Low, June 8, 2018)

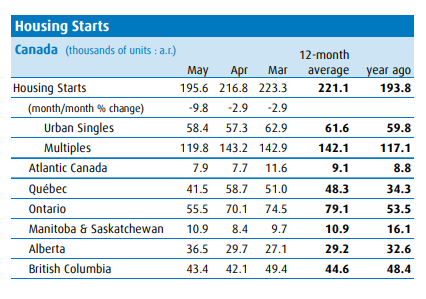

Canadian housing starts declined nearly 10% to 195,500 (annualized) units in May, extending the softer run of construction activity which began early in the year. As the BMO article notes, most of the decline in May’s starts was centered in urban, multi-family units which dropped a hefty 16%.

There are many reasons why multi-unit starts recently declined despite continuing strong demands in Toronto and Vancouver.

The barriers which are often cited are zoning restriction time delays, permit hold-ups, rising material costs, and of course, increased borrowing costs and new affordability issues.

On a regional basis, starts in May fell quite sharply in Quebec and Ontario and were up a bit in Alberta and BC.

The recent housing start correction in Toronto and Vancouver should not be too alarming considering the huge surge in construction in previous months. Moreover, the latest data indicate that building permits were up 17.1% year over year as of April, reinforcing the argument that housing starts should remain relatively strong over the balance of this year.

Nonetheless, a National Bank analysis concludes that housing starts will likely be a negative factor for Canadian economic growth in the second quarter.

Â