The Bank of Japan gathered its policymaking members in Tokyo at the end of last week. The statements released and the commentary given pursuant to it exuded a renewed darkness. When they had last met on April 26 and 27, things were already different. But the conclave before that, March 8 and 9, they were practically giddy.

What a difference a few months make, not that these Economists have any idea why.

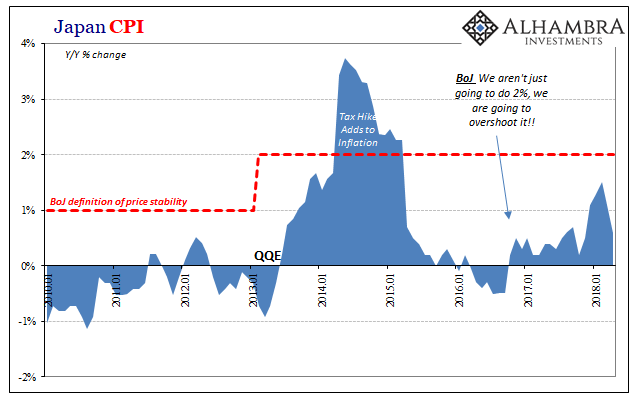

Back at the end of February, Japan’s Ministry of Internal Affairs and Communications reported that the nation’s inflation rate had accelerated significantly. From just +0.5% year-over-year in November 2017, the CPI suggested a possible shift. It would rise 1.1% in December and then 1.3% in January.

The news was met with confidence at the BoJ. They began talking about exiting QQE entirely with their inflation target almost certainly in the bag. For once, things seemed to be going their way and in a clear fashion.

Though the CPI rate would accelerate further to 1.5% for February (figures released on March 23), it has since collapsed. At the April BoJ meeting the reported headline inflation rate for March was pulled back to just 1.1%. It was then that Japanese policymakers simply dropped their timeframe for achieving 2% inflation. It was there at the March meeting, as always about two years ahead, but it just disappeared from statements after the disappointment handed to them in time for their gathering at the end of April.

Between then and now, inflation has dipped further. The CPI for April, released May 18, had retreated all the way down to 0.6%, practically a complete round trip from last November. The confident smiles are all gone.

Instead, Japanese central bankers are confused. When they ever encounter this sort of unpredictable (from their perspective) misbehavior they always appeal to the absurd. In its statement last week, the BoJ lamented:

Japan’s economy is seeing labor markets tighten and the output gap improving, but prices aren’t rising much. As such, it’s most appropriate to patiently maintain our powerful monetary easing.