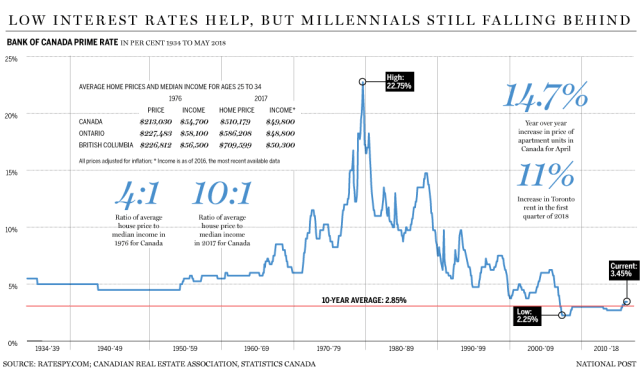

As shown in this chart, the median household income in Canada for ages 25 to 34 declined from 54K in 1976 to 49K in 2016 even as most families moved from one to two income earners. Meanwhile, interest rates moved through the widest range in 5000 years of data, with the prime rate falling from 22% in 1980 to 2.25% by 2016. In the process, the average home price ballooned from 4x median household income to an unprecedented 10x by last year. It should be no surprise then that just one in three Canadians under 35 were homeowners in 2017, compared to one in two in 1976 (UBC). See: Millennial housing crisis? Turns out it’s real and worse than you thought

Based on historical norms, it is entirely likely that this housing cycle will conclude with 30%+ price drops and a decade and more before today’s prices are seen again. So the challenge for young and old today is to respond to the current real estate cycle in ways which are beneficial to their own life cycle. For people 50+ that may mean downsizing their home or selling vacation properties sooner than later, and for younger people, it may mean renting longer and not hurrying to bury themselves in debt to buy housing at current levels. As for parents helping their kids:

In April, Glover finally landed a one-bedroom condominium for a little less than $600,000. But he doubts he’d ever have pulled it off without his parents.

“That was super helpful,†he said. “It made a huge difference.â€

Thoughtful minds should ask is it ‘helpful’ to enable young people to buy into one of the most heinously overvalued property markets on the planet? Time will tell.