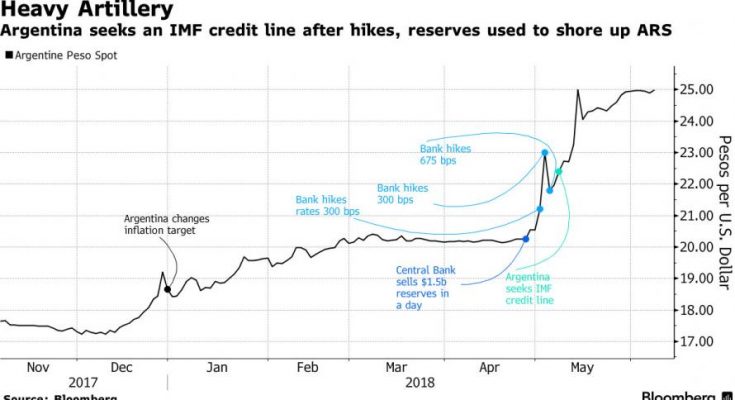

Just a few weeks after Argentina became ground zero for the coming Emerging Market crisis, when its currency suddenly collapsed at the end of April amid soaring inflation, exploding capital outflows and a central bank that was far behind the curve (as in “13% of rate hikes in a week” behind)…

Â

… the IMF has officially bailed out the country – again – this time with a $50 billion, 36-month stand-by loan, and coming in about $10 billion more than rumored earlier in the week, it was the largest ever bailout loan in IMF history, meant to help restore investor confidence in a nation that, between its soaring external debt and current account deficit, prompted JPMorgan to suggest that along with Turkey, Argentina is in effect, doomed.

As the JPM chart below shows, the country’s total budget deficit, which includes interest payments on debt, was 6.5% of GDP last year, much of reflecting a debt binge of about $100 billion over the last two and a half years. The primary fiscal deficit in 2017 was 3.9%.

The loan will have a minimum interest rate of 1.96% rising as high as 4.96%.

“We are convinced that we’re on the right path, that we’ve avoided a crisis,†Finance Minister Nicolás Dujovne said at a press conference in Buenos Aires. “This is aimed at building a normal economy.â€

Dujovne said that about $15 billion from the credit line would be immediately available to Argentina after the package is approved by the IMF’s board, which is expected on June 20. The rest would be dispersed as needed as Argentina meets its targets.

Shortly after the news, the loan was finalized, Dujovne made some additional, more bizarre comments, saying that “the amount we received is 11 times Argentina’s quota, which reflects the international community´s support of Argentina,” almost as if he was proud at just how insolvent his country “suddenly” become. He was certainly delighted that, in his view, Argentina is now “too big to fail”, and received not only this loan as a result…

“It’s very good news that the integration with the world allows us to receive this support.”