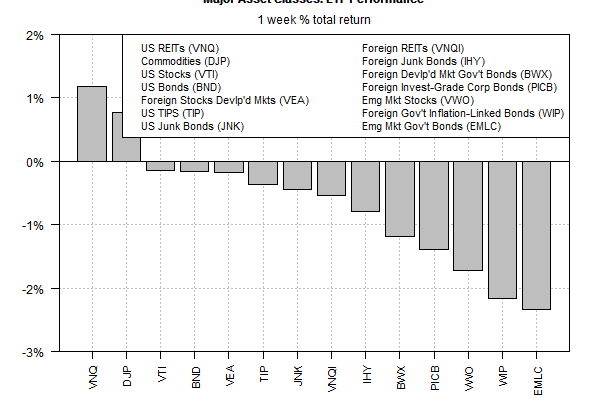

Real estate investment trusts (REITs) in the US again posted the biggest weekly gain among the major asset classes, based on a set of exchange-traded products. The ongoing bounce for REITs contrasts with a generally down week for most markets over the five trading days through May 4.

Vanguard Real Estate (VNQ) rose 1.2% last week, lifting the ETF to its highest close since January 31. The recent strength in REITs follows a sharp selloff that was triggered in part by concerns that rising interest rates could weigh on the yield-sensitive sector.

But Thomas Bohjalian, executive vice president at Cohen & Steers, a money manager focused on real estate, says that higher interest rates aren’t always bad news for REITs. “Rising rates don’t happen in a vacuum,†he tells Forbes. “Interest rates are part of the equation, and sudden moves in bond yields can create volatility. But REITs are not bonds.â€

Bohalian points out “in an improving economy, landlords can raise rents as tenants fight for more space, potentially increasing cash flows to offset the effects of higher rates.â€

In other words, “it should matter why rates are rising, not simply that rates are rising.†Rising Treasury yields have been historically positive for REITs when accompanied by a stronger economy, and the pullback represents an opportunity for dividend investors to take advantage of the opportunity by capitalizing on some REITs with high-paying dividends.

Meanwhile, broadly defined commodities posted the second-best performance last week. Otherwise, the rest of the major classes fell. The biggest loss was in bonds for emerging markets. VanEck Vectors JP Morgan Emerging Market Local Currency Bond (EMLC) slumped 1.1%, leaving the ETF at its lowest weekly close so far in 2018.

Â

For the one-year trend, most of the major asset classes are still enjoying gains, although the top performer is now foreign REITs/real estate, displacing stocks in emerging markets, the long-running one-year leader until last week.