Below is a brief recap of last week’s price projections and the price targets for next week.

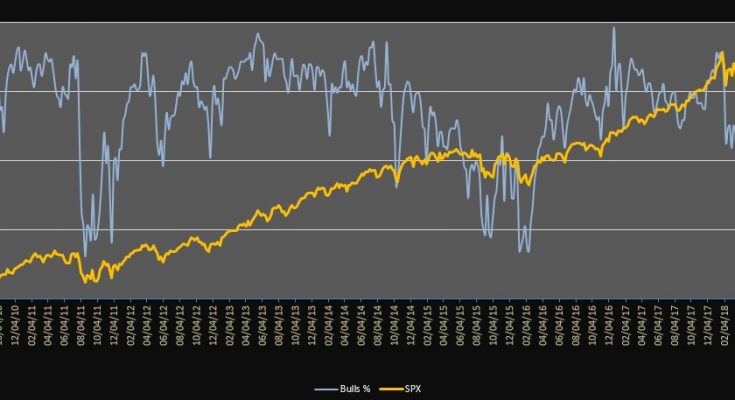

In analyzing the major indices we pay close attention to market breadth indicators. Whether the market moves up, down or sideways, market breadth goes through fairly regular overbought/oversold cycles which give timely clues for when to get aggressive or defensive. One such indicator is the daily Pattern Oscillator, which gave an overbought signal at the end of last week, and needs another day or two before it gets oversold again. For the longer-term perspective, we keep track of the weekly sentiment indicator, which continues to hover around 50%:

What sentiment tells us currently is that there’s lack of conviction among bulls and bears alike, which is reflected in a sideways moving market favoring short-term swing trades:

The projected price range for the E-Mini remains unchanged from last week: 2660 – 2770. You can keep track of our daily and intraday market updates here. With the exception of EUR and JPY, the USD continued its consolidation against the rest of the G6 currencies.

The Euro remained weak and finished the week sandwiched between our projected down target and the 5 day CIT Angle target.

The projected price range for next week for EURUSD is 1.165 – 1.19:

The Pound continued weakening, although at a much slower pace, and remained confined to the middle of the down sloping channel.

The projected trading range for next week for GBPUSD is 1.332 – 1.3365:     Â

USDJPY exceeded slightly the upside channel projection and met resistance at the CIT Angle target. The strong uptrend reversal which started at the end of March continues unabated. The indicator at the bottom demonstrates the futility of trying to trade against the trend. While the USD was declining against the JPY, the bear swing gains (red bars) far outpaced the gains from any long counter swing trades (green bars). The opposite is true after the shift in trend occurred.