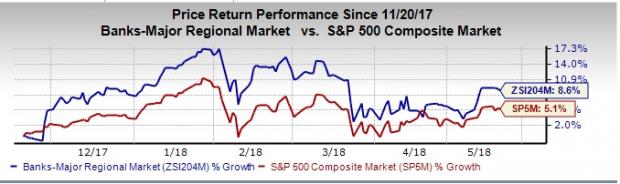

Over the last five trading days, banking stocks put up a lackluster show. Though improving U.S. economic data and rising 10-year Treasury bond yields were positives, investors were a bit concerned on the time uncertainty related to the easing of banking regulations and soft loan growth. Nevertheless, strong economy and increasing commodity prices aided a rise in bond yields followed by mortgage rates.

Mortgage rates improved to 4.61%, recording a seven-year high since May 2011, as the 10-year Treasury yield hit 3.122%, the highest level since July 2011, on a sell-off recorded in the bond market. However, homeowners seeking lower rates for refinancing are definitely big-time losers. Increases in mortgage rates will limit refinancing activity.

Further, litigation and probes pertaining to banks’ past shoddy activities dominated headlines. The law enforcement agencies are also on track to work to resolve such issues and avoid lengthy litigation.