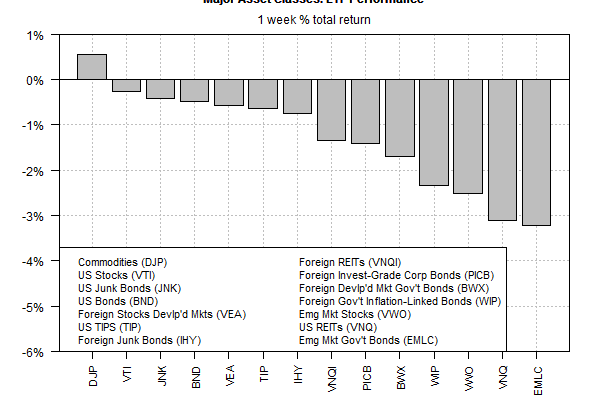

Markets declined last week in nearly every corner of the major asset classes, with the lone exception of broadly defined commodities, based on a set of exchange-traded products.

The iPath Bloomberg Commodity (DJP) gained 0.6% over the five trading days through May 18. The increase lifted the exchange-traded note close to its highest level in a month.

“The rally likely has room to run, particularly from a returns perspective,â€Â advised Jeffrey Currie, Goldman’s global head of commodities in a note to clients last week. “Oil fundamentals are now more bullish as robust demand faces supply disappointments.â€

Bloomberg this morning reports that “commodities were a big casualty of the escalating trade war between the US and China, but are now set to be a major beneficiary of Beijing’s pledge to import more American goods.â€

Otherwise, losses dominated last week’s trading for the major asset classes. The deepest setback: bonds in emerging markets. The VanEck Vectors JP Morgan Emerging Markets Local Currency Bond (EMLC ) tumbled a hefty 3.2%, leaving the fund at its lowest price in a year.

A firmer US dollar and rising US interest rates are taking a toll on assets in emerging markets generally – for bonds and stocks in these countries. Although the long-term growth story remains compelling for emerging markets, the short-term outlook could be rocky, particularly for countries with shaky finances.

Adam Slater of Oxford Economics tells the FT that “the worst situation is to have a high debt service ratio [to GDP] and one that is vulnerable to rising US dollar rates.†Turkey, Brazil, Chile, and Malaysia are on his short list of economies with the highest risk of possible blowback due to higher Treasury yields.

For the one-year trend, the performance profile is considerably brighter, notably for equity returns, which remain comfortably positive across the board. The strongest advance at the moment can be found in US stocks. Vanguard Total Stock Market (VTI) is up 17.5% on a total return basis.