Most of the sectors are in good shape right now. Â

This bodes well for the overall direction that the market has been on this month.Â

Yes, there are some obstacles for it to overcome, in forms of strong price resistance overhead, but we are seeing the typical market resiliency that we saw during much of 2017, come through this week. In particular the ‘Buy the Dip’ mentality has shown its hand this week, keeping the market from dipping lower, despite bearish headlines wishing to take it lower.Â

Here’s what I see as the top 3 sectors right now:

- Technology

- Discretionary

- Industrials

Energy dropped off of this list, but I think it could easily come back at the next Sector Update, as it is simply a pullback to its rising trend-line. A bounce at its current price should see it make another strong push higher.Â

The 3 worse sectors are:

- Staples

- Utilities

- Financials

Staples and Utilities continues to struggle. But that has been the story for most of this year, while Financials have been one of the more boring sectors of the past few months. Now it finds itself in the bottom three.Â

Let’s review the sectors:

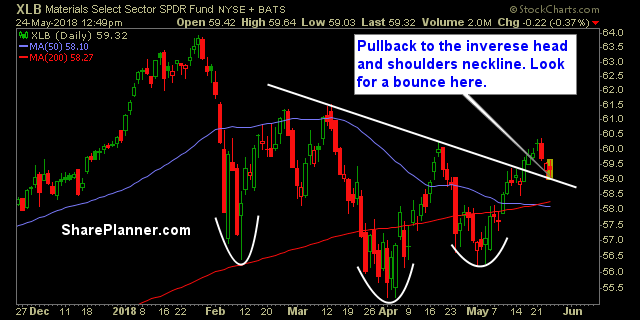

Basic Materials (XLB)

Energy (XLE)

Financials (XLF)Â

Industrials (XLI)

Technology (XLK)

Consumer Staples (XLP)

Utilities (XLU)

Health Care (XLV)

Consumer Disretionary (XLY)